Key Takeaways

- Verra runs the world's largest carbon crediting program, but DACH sustainability leaders must treat VCS labels as a starting point—not a quality guarantee—and layer on methodology filters, CCP alignment checks, and independent ratings before any purchase.

- You can still use Verra credits credibly after the REDD+ controversies, but only by excluding legacy renewables and most cookstoves, requiring current methodologies (VM0047 for ARR, VM0048 for REDD+), and documenting every project with audit-ready evidence packs.

- Under CSRD/ESRS E1 and EU consumer law, Verra credits sit strictly in 'beyond value chain mitigation'—they cannot reduce your reported Scope 1–3 emissions, hit E1 targets, or justify generic 'climate neutral' product claims without triggering legal and reputational risk.

- The safest path forward is a diversified, multi-registry portfolio with Verra as one component: combine CCP-approved reductions (landfill gas, jurisdictional REDD+) with permanent removals (ARR, biochar), screen everything via tools like Senken's Sustainability Integrity Index, and keep full documentation for assurance reviews.

Verra is the nonprofit behind the Verified Carbon Standard (VCS)—the world's largest carbon crediting program, accounting for roughly 63% of voluntary market retirements in 2024. If your company has bought or is considering carbon credits, chances are high you've encountered Verra projects: forestry and REDD+ initiatives, renewable energy, cookstoves, or landfill gas capture.

But here's the reality you're living: media investigations into "phantom credits," ICVCM quality shifts, tightening CSRD/ESRS E1 rules, and German court rulings on 'klimaneutral' claims have turned what used to be a straightforward procurement decision into a compliance and reputational minefield. Internal sceptics are asking harder questions. Auditors want documentation. Regulators are watching your disclosures.

This article isn't a debate about whether Verra should exist—it's a practical playbook for how to use (or avoid) specific Verra credits in ways that will survive auditor reviews, board scrutiny, and EU regulations. We'll walk through what Verra is, how its credits work, which methodologies and project types pass today's integrity bar, and how to build a defensible, CSRD-ready portfolio with Verra as one carefully managed component.

Verra in Plain Language: What It Is and Why It Matters

Verra is a US-based nonprofit that runs the Verified Carbon Standard (VCS), the world's largest carbon crediting program. As of 2024, Verra still accounts for roughly 63% of voluntary carbon market retirements, with over 2,000 registered projects spanning forestry, renewable energy, waste management, and land use. For DACH sustainability leaders, this dominance means one thing: whether you're starting your carbon credit strategy or auditing an existing portfolio, you'll encounter Verra credits.

Here's what that means in practice. Most corporate portfolios include VCS-certified projects in three main categories: forestry and REDD+ (avoiding deforestation), renewable energy (wind, solar, hydro), and cookstove distribution. If your company has already purchased carbon credits, there's a strong chance they carry a Verra label. The challenge? Not all Verra credits are created equal, and regulators, auditors, and NGOs now demand much stricter scrutiny than they did before 2023.

The shift matters because Verra faced significant public criticism over baseline credibility in legacy REDD+ projects and over-crediting concerns in older methodologies. In response, Verra introduced consolidated methodologies (VM0047 for afforestation/reforestation, VM0048 for REDD+ with jurisdictional baselines), enhanced risk-based project reviews, and aligned with the ICVCM's Core Carbon Principles framework. For DACH corporates navigating CSRD reporting obligations, the question isn't whether to avoid Verra entirely but how to separate high-integrity Verra credits from legacy stock that no longer meets today's standards. Treating the Verra label as a starting point, not a quality guarantee, is now the baseline expectation for responsible procurement.

How Verra Credits Work: From Project Idea to Retirement (and What You Should Always Check)

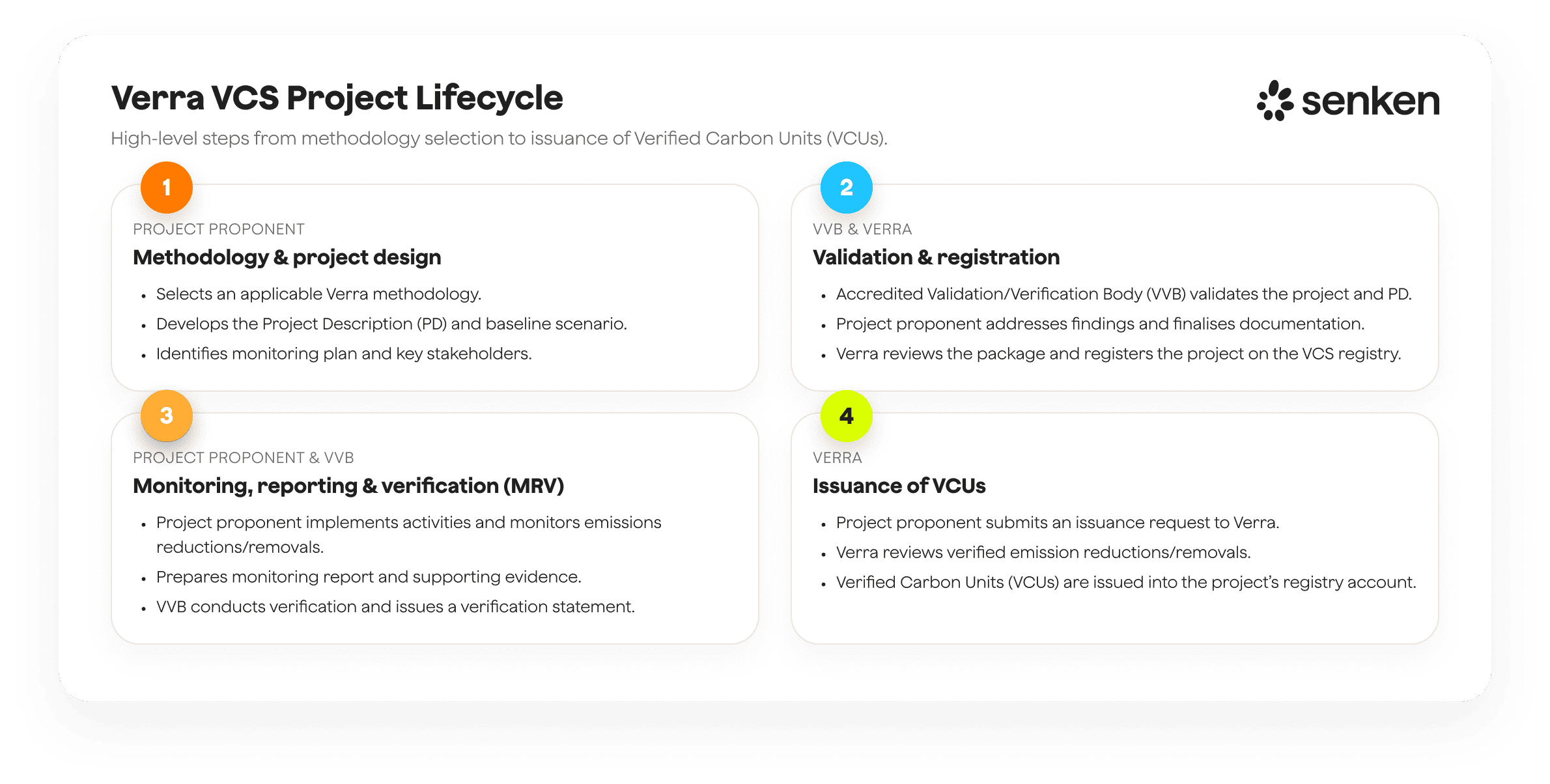

Understanding the Verra project lifecycle helps you know what documentation to demand and where quality controls sit. Every VCS project follows a standard path: a project developer designs the project using an approved methodology, submits a Project Description (PD) to Verra, undergoes third-party validation by an accredited Validation and Verification Body (VVB), gets registered on the Verra Registry, implements monitoring per the methodology, submits Monitoring Reports (MRs), undergoes third-party verification, receives Verified Carbon Units (VCUs) upon issuance, and finally retires those credits on behalf of a buyer.

Each step generates a paper trail. The Project Description explains the baseline scenario, additionality justification, monitoring plan, and safeguards. The Monitoring Report documents actual project performance, carbon calculations, and any deviations. VVB reports provide independent assurance that the project meets methodology requirements. The Verra Registry records all issuances, transfers, and retirements with serial numbers, making every transaction traceable. For AFOLU (agriculture, forestry, and other land use) projects, Verra's Non-Permanence Risk Tool assesses reversal risks and determines buffer contributions to cover potential carbon losses.

Before approving any Verra credit purchase, insist on this minimum documentation set: the exact project ID and current methodology version, the full Project Description and latest Monitoring Report, validation and verification reports, any loss-event or suspension notices from Verra, and registry serial numbers for the specific vintage you're buying. This isn't bureaucracy; it's your audit defense. Under CSRD, your external assurance provider will ask for precisely these documents to verify E1-7 disclosures on carbon credits. Companies that skip this step discover gaps only when auditors arrive. Platforms like Senken's Sustainability Integrity Index automate much of this document retrieval and cross-checking, turning a multi-day manual task into a structured, repeatable control.

Integrity, Controversy, and New Rules of Thumb for Verra Credits

Let's address the elephant in the room: Verra's reputation took a hit in 2023. The Guardian, Die Zeit, and SourceMaterial published investigations alleging that many REDD+ projects issued "phantom credits" with inflated baselines that overstated deforestation risk. Academic research, notably West et al. in Science, used synthetic control methods on 26 REDD+ projects and found limited evidence of reduced deforestation compared to control areas. Verra disputed the findings, citing methodological flaws, and other scientists published rebuttals. Separately, Brazilian authorities suspended several Amazon REDD+ projects amid investigations into land-tenure irregularities, and US prosecutors charged a former Verra board member with fraud related to over-issued cookstove credits.

These controversies don't mean all Verra credits are worthless; they mean you need clear procurement filters. Here's what changed and what you should do:

Legacy REDD+ and baselines: Older project-level REDD+ methodologies allowed developers to set their own deforestation baselines, creating over-crediting risk. Verra's response was VM0048, which uses jurisdictional activity data and risk mapping instead of project-level estimates. Your rule: Avoid pre-VM0048 REDD+ projects unless you have independent geospatial analysis confirming the baseline. Prefer jurisdictional REDD+ through ART TREES or nested VM0048 projects once they're issuing credits.

Renewable energy and additionality: The ICVCM rejected most renewable energy credits because grid-connected wind and solar in mature markets no longer face financial or regulatory barriers. Your rule: Exclude legacy renewables in OECD grids. If you hold them, don't count them toward SBTi or CSRD-aligned strategies.

Cookstove over-crediting: A 2024 Berkeley study found cookstove credits were overestimated by a factor of ten due to unrealistic usage assumptions. Verra introduced VM0050 with stricter monitoring. Your rule: Treat legacy cookstove credits as high-risk. Only consider new cookstove projects under VM0050 or ICVCM-approved equivalents.

Governance and tenure risks: The Brazil suspensions highlight that even registered projects can face legal challenges. Your rule: Screen for land-tenure documentation, Free Prior and Informed Consent (FPIC) records, and adverse media. Use tools like Senken's Sustainability Integrity Index, which flags governance and reputational risks across 600+ data points.

These filters turn controversy into operational clarity. You're not debating the science; you're building a defensible exclusion list that protects your company from both carbon and reputational risk.

A Lean Due-Diligence Framework for Verra Projects (Built for Busy Sustainability Teams)

Most sustainability teams don't have time to read 300-page Project Descriptions for every credit they buy. You need a structured, repeatable screening process that escalates only genuine risks. Here's a six-step framework designed for efficiency:

Step 1: Pre-screen by methodology and category. Start with a whitelist: current VCS methodologies (VM0047, VM0048, VM0050), ICVCM Core Carbon Principles-approved categories, and methodologies aligned with your internal policy (e.g., removals-only or specific co-benefit requirements). Automatically exclude legacy renewables in mature grids and non-CCP-compliant cookstoves. This cuts your review universe by 60-70%.

Step 2: Verify additionality and baseline robustness. Pull the Project Description and check: Does the baseline scenario reflect realistic business-as-usual? Does the additionality case rely on dated regulations or financial assumptions? For REDD+ projects, confirm whether the project uses jurisdictional baselines (VM0048) or independent spatial analysis. For ARR (afforestation/reforestation), check barrier analysis and common-practice tests.

Step 3: Assess over-crediting and leakage. Compare claimed emission reductions in the Monitoring Report against independent benchmarks where available. For AFOLU projects, verify that leakage deductions are applied and that geospatial monitoring (satellite, drone) validates project boundaries and land-use changes.

Step 4: Evaluate permanence and reversal risk. For forestry and soil carbon projects, review the AFOLU Non-Permanence Risk Tool output and buffer contributions. Check Verra's registry for any recorded loss events (fire, logging, disease). Confirm the project has a 40-year permanence commitment and active monitoring.

Step 5: Check safeguards and co-benefits. Look for Climate, Community & Biodiversity (CCB) or SD VISta labels. Review stakeholder consultation records, grievance mechanisms, and any social or environmental impact assessments. Projects without these layers carry higher reputational risk.

Step 6: Cross-check with external ratings and flags. Use ICVCM's CCP label status, ratings from agencies like BeZero or Sylvera, and adverse-media screening. If multiple independent sources flag a project, escalate for deeper review or exclude.

Document your decision in a one-page internal memo per project: methodology and vintage, key quality indicators (baseline, leakage, buffer), external ratings, and approval rationale. This memo becomes your audit trail under CSRD. Senken's Sustainability Integrity Index automates steps 1 through 6, scoring projects across 600+ data points and flagging those that fall below high-integrity thresholds, so your team focuses only on final approvals rather than manual research.

Where Verra Credits Fit in Your Net-Zero, SBTi and CSRD Strategy

Verra credits are not a shortcut to hitting your Scope 1-3 reduction targets. Under CSRD's ESRS E1, companies must report gross emissions without netting out carbon credits, and credits must be disclosed separately in E1-7. The EU Empowering Consumers Directive bans generic "climate-neutral" product claims based solely on offsetting from 2026, and Germany's Federal Court of Justice ruled in June 2024 that "klimaneutral" advertising must explicitly clarify whether it refers to reductions or compensation.

Here's the compliant use case: Verra credits belong in beyond-value-chain mitigation (BVCM) and neutralization of residual emissions. BVCM means financing emission reductions or removals outside your own value chain to support global climate goals, while neutralization addresses the emissions you genuinely cannot eliminate even after deep decarbonization. Both are legitimate under SBTi's Net-Zero Standard and the Oxford Offsetting Principles, but neither reduces your reported Scopes or allows you to claim your product is "carbon neutral" without detailed context.

Translate this into your internal policy with three clear rules:

Rule 1: Credits are a complement, not a substitute. Your net-zero roadmap must prioritize absolute emission reductions across Scopes 1, 2, and 3. Credits enter only after you've exhausted feasible reduction levers. Quantify your residual emissions (the unavoidable remainder at your target year) and size your credit strategy accordingly.

Rule 2: Separate credits from gross emissions in reporting. In your CSRD sustainability statement, disclose total Scope 1-3 emissions without deductions, then report carbon credits separately under E1-7 with details on volume, project types, methodologies, share of removals vs reductions, and CCP alignment. Show your reduction trajectory and credit use as distinct lines.

Rule 3: Tighten claims language. Replace "carbon neutral" or "klimaneutral" with precise framing: "We finance high-integrity carbon removal projects to neutralize our residual emissions" or "Beyond our value chain, we support X tonnes of verified emission reductions annually." Make it clear that credits contribute to climate action but do not reduce your operational footprint.

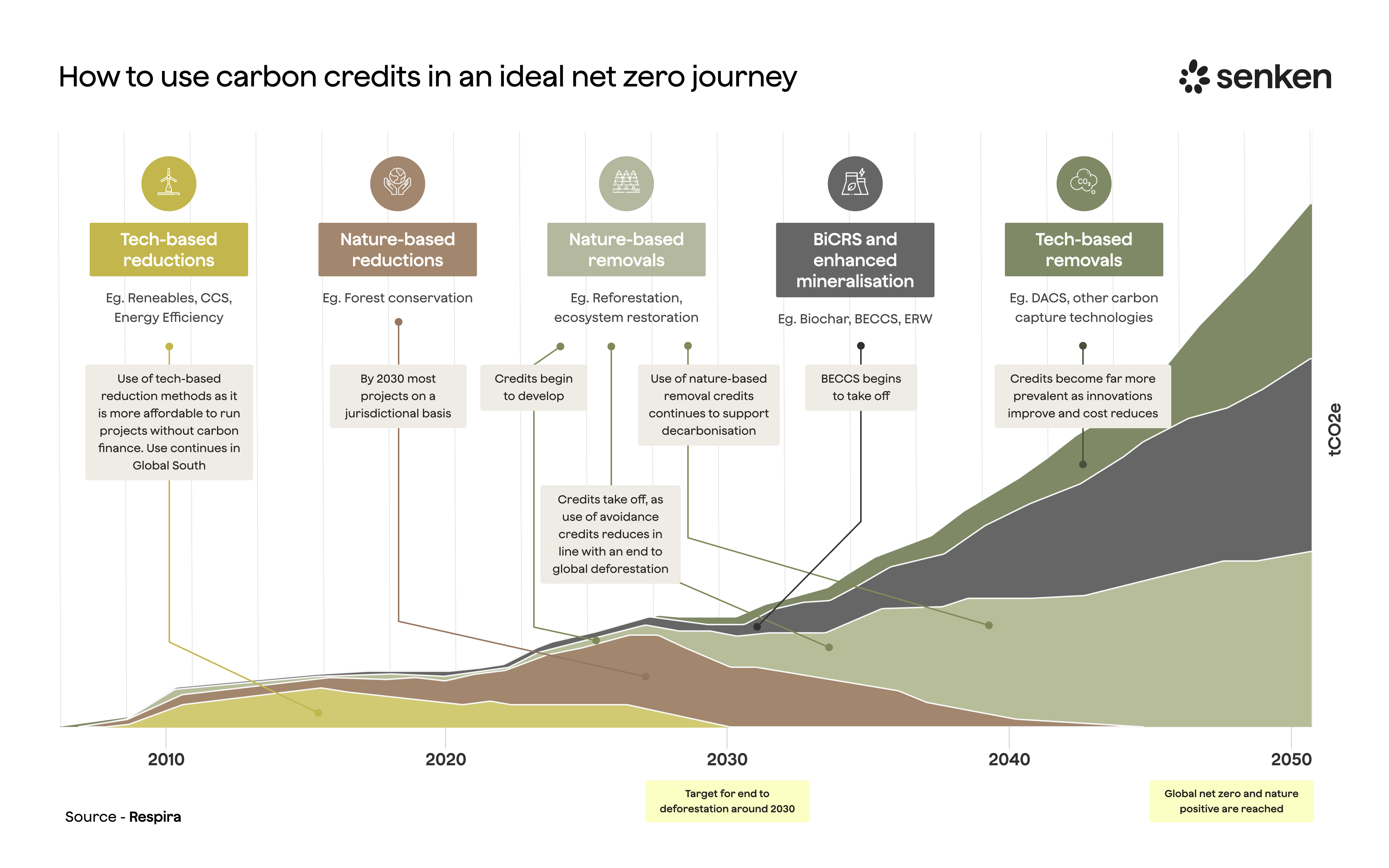

This framing protects you legally and aligns with the trajectory of EU regulation. The upcoming Carbon Removal Certification Framework (CRCF) will create an EU-wide standard for removals, and while CRCF units are distinct from VCS credits, the regulatory direction is clear: removals and avoidance credits will be governed separately, and only high-integrity removals will qualify for future compliance schemes. Position your Verra strategy to gradually shift toward CCP-approved removals (ARR under VM0047, tech-based removals) so you're ready when EU rules tighten further.

Building a Balanced Portfolio: Verra vs Other Standards and a Step-by-Step Buying Workflow

Verra is one tool in a diversified toolkit. Smart buyers combine VCS credits with projects from Gold Standard, ACR, ART TREES, and permanent-removal registries like Puro.earth to balance cost, integrity, co-benefits, and future-proofing. Here's how they compare:

Verra (VCS): Broadest project catalog, largest market share, strong on forestry and land use. New methodologies (VM0047, VM0048) meet ICVCM standards. Weakness: legacy portfolio includes low-additionality renewables and over-credited cookstoves. Use Verra for: jurisdictional REDD+ (VM0048), ARR (VM0047), and landfill gas or waste projects with CCP approval.

Gold Standard: Known for rigorous safeguards, stakeholder consultation, and SDG alignment. Preferred when co-benefits (health, gender, livelihoods) are strategic priorities. Smaller project pipeline than Verra but higher average quality. Use Gold Standard for: household energy (cookstoves with strict monitoring), community-based projects, and portfolios where ESG storytelling matters.

ART TREES: Jurisdictional REDD+ at scale, with government-level accounting and nested projects. CCP-approved. Use ART for: large-volume REDD+ purchases where you want jurisdictional integrity and alignment with national UNFCCC commitments.

Puro.earth, ACR, CDR.fyi: Focused on durable carbon removals (biochar, enhanced weathering, direct air capture). Higher cost per tonne but permanence exceeds 1,000 years. Use removal registries for: meeting Oxford Principles' durability thresholds, future-proofing against CRCF, and balancing short-lived nature-based credits.

A defensible portfolio for a large DACH corporate in 2025 might look like: 60% CCP-approved reductions (Verra VM0048 REDD+, Gold Standard household energy, Verra landfill gas), 40% removals (Verra VM0047 ARR, Puro biochar, enhanced weathering).

Adjust the mix based on budget, risk tolerance, and how quickly you want to shift toward permanence.

Five-step buying workflow:

- Define objectives and boundaries: Decide the role of credits (BVCM, residual neutralization), set annual volume targets, establish exclusions (no legacy renewables, no non-CCP cookstoves), and agree on claims language with legal and comms.

- Shortlist eligible standards and methodologies: Use the comparison above to select registries. Within each, whitelist only current methodologies and CCP-approved categories. Document your rationale in an internal procurement policy.

- Screen projects with the due-diligence framework: Apply the six-step checklist (methodology, additionality, leakage, permanence, safeguards, external ratings) to individual projects. Use Senken's Sustainability Integrity Index to pre-filter the market and surface only top-tier projects.

- Coordinate approvals and execute purchases: Share the internal decision memo with procurement, legal, and finance. Lock in pricing through forward contracts or multi-year offtakes to hedge against cost increases. Retire credits on the registry with your company name and reporting-year tag.

- Store CSRD-ready documentation and review annually: Keep Project Descriptions, Monitoring Reports, VVB reports, CCP labels, registry serials, and internal approval memos in a centralized folder. Update your credit policy each year as methodologies, CCP labels, and regulatory guidance evolve.

Senken streamlines steps 2 through 5 by curating pre-screened portfolios, managing procurement logistics, and delivering audit-ready evidence packs that map directly to ESRS E1-7 disclosure requirements. This turns a multi-month internal project into a structured, repeatable process that scales as your volumes grow.

.svg)