TL;DR

- Carbon neutral and net zero aren't interchangeable – carbon neutral typically covers Scopes 1–2 with heavy offset use, while net zero demands 90%+ reductions across all scopes before using permanent removals for residuals, and mixing them up is now a legal risk under EU rules.

- For large companies, net zero aligned with SBTi should anchor your long-term strategy; carbon neutral claims, if used at all, must be tightly scoped (e.g., "carbon neutral operations for 2025"), backed by high-quality credits, and transparently disclosed to survive CSRD assurance and avoid greenwashing accusations.

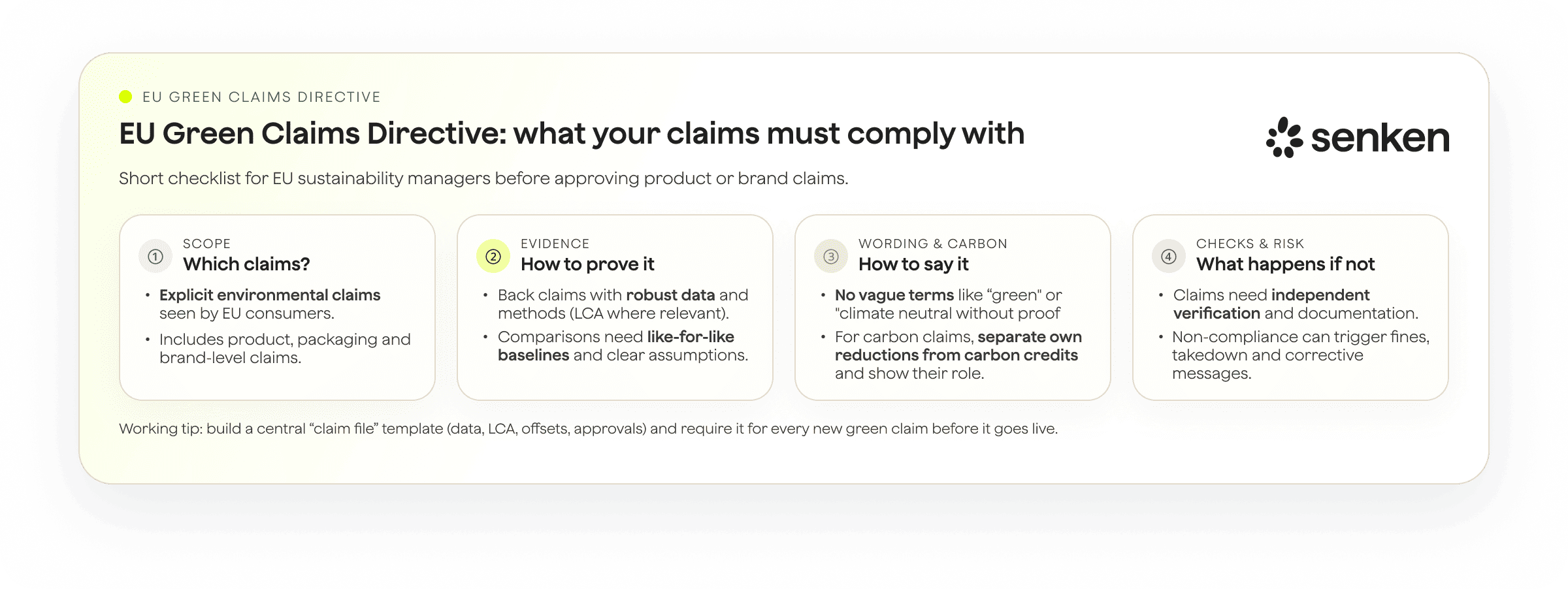

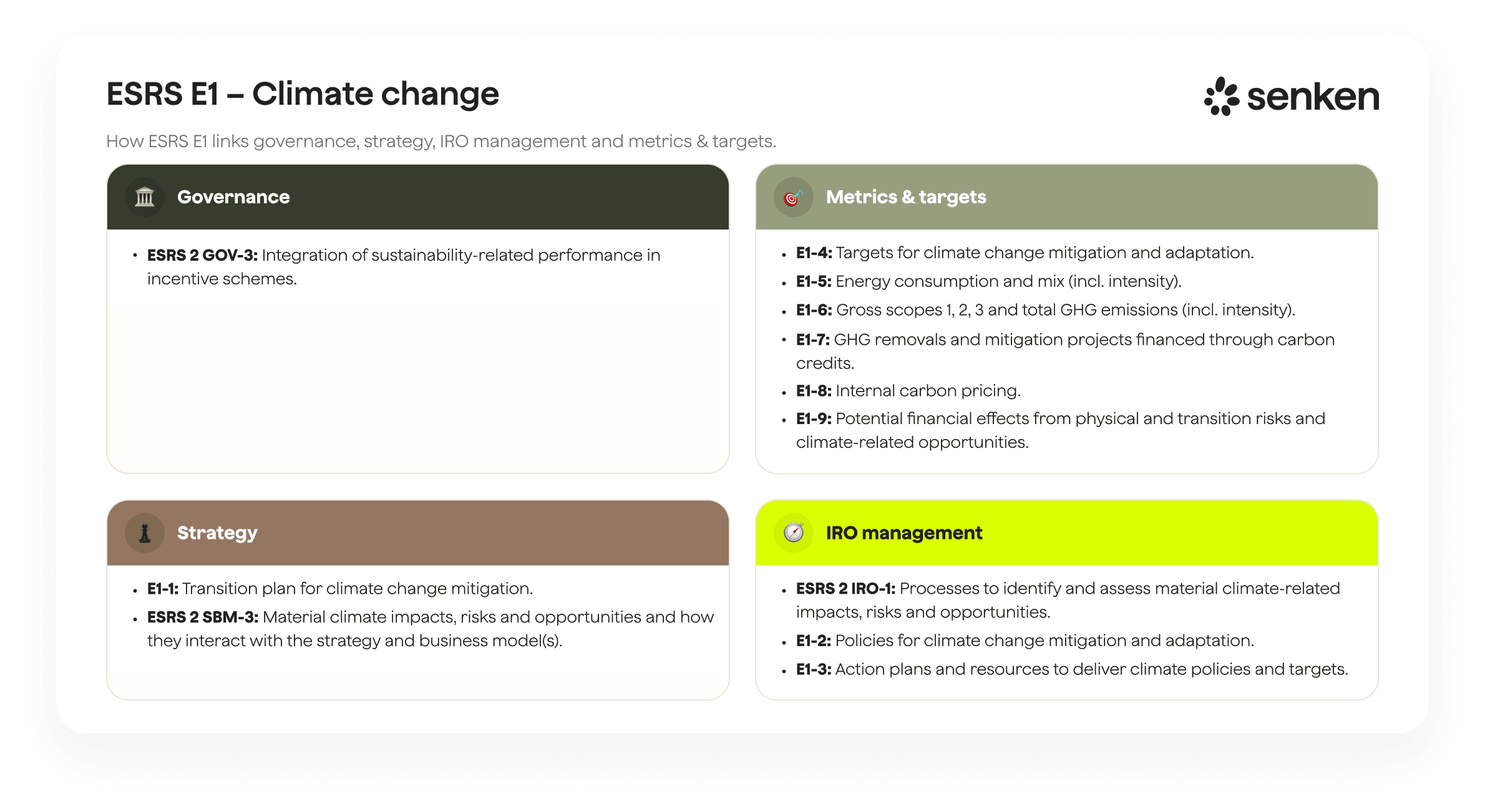

- CSRD/ESRS E1 and the EU Green Claims Directive require you to separate real reductions from compensation, disclose carbon credit volumes and types in detail, and avoid generic neutrality claims based on offsets alone – auditors and regulators now expect the same rigour for climate targets as they do for financial statements.

- High-integrity carbon credit procurement – prioritising removal over avoidance, demanding additionality and permanence, and using independent verification like ISO 14068-1 or SBTi – is non-negotiable if you want your claims to pass audit, regulator, and NGO scrutiny in 2025 and beyond.

Right now, 62% of industrial companies in Germany, Austria, and Switzerland say they'll hit carbon neutrality within ten years, and over 70% of Europe's largest corporates have validated net-zero targets. But here's the problem: carbon neutral and net zero mean very different things, and using them loosely is turning into a legal and reputational liability. German courts have already banned "climate neutral" product claims that rely on offsets without transparency, the EU's Green Claims Directive will effectively prohibit generic carbon neutral advertising from 2026, and CSRD auditors are now asking exactly how much of your progress comes from real cuts versus carbon credits.

Carbon neutral vs net zero isn't just semantics – it's the difference between a near-term claim built largely on offsets (carbon neutral) and a science-based, long-term transformation requiring 90%+ emissions reductions before using permanent removals (net zero). This guide walks you through the precise definitions, the decision framework, and the strategy you need to back either claim – so you can move from ambition to defensible, compliance-ready action.

Carbon neutral vs net zero: clear definitions in plain language

Carbon neutrality means balancing your emissions with an equivalent amount of carbon removal or offsetting. Under ISO 14068-1 and PAS 2060, you quantify your greenhouse gas footprint (typically Scopes 1 and 2, plus significant Scope 3 categories), reduce where feasible, then compensate residual emissions by purchasing certified carbon credits. The key principle is a mitigation hierarchy: reduce first, offset what remains. Carbon neutral claims are often used for near-term goals, specific operations, or defined products.

Net zero is fundamentally different. Following the SBTi Corporate Net-Zero Standard, it requires reducing absolute emissions by 90 to 95% across all scopes (1, 2, and 3) before using permanent carbon removals to neutralize the small residual. Net zero is a long-term transformation, typically targeting 2040 to 2050, aligned with limiting global warming to 1.5°C. It's not about balancing today's emissions with offsets but about decarbonizing your entire value chain

Here's a practical comparison: A carbon-neutral operations claim for 2025 might involve reducing Scope 1 and 2 emissions by 30% and offsetting the rest with high-quality credits. A net-zero target for 2040 means slashing Scopes 1, 2, and 3 by over 90%, with only unavoidable residuals (perhaps hard-to-abate process emissions or essential business travel) compensated through durable removals like biochar or direct air capture.

Both are grounded in the GHG Protocol's scope framework. Scope 1 covers direct emissions from sources you own or control. Scope 2 includes indirect emissions from purchased energy. Scope 3 captures your value chain, from supplier emissions to product use and end-of-life. For most corporates, Scope 3 dominates the footprint, which is why net zero is more ambitious and why carbon-neutral claims often stop at Scopes 1 and 2.

The difference between carbon neutral and net zero for large DACH companies

Let's translate those definitions into what they mean for your strategy and stakeholder conversations.

Emissions coverage and ambition. Carbon-neutral claims typically cover Scopes 1 and 2, sometimes adding selected Scope 3 categories like employee commuting or business travel. Net-zero targets must include the full value chain. For a industrial with complex supply chains, that means tackling purchased goods, logistics, and downstream use of products. The SBTi explicitly states that offsets cannot substitute for real decarbonization in science-based targets. Net zero demands transformation, not compensation.

Reduction vs compensation balance. A carbon-neutral claim might involve 20 to 40% internal abatement paired with offsetting the rest. Net zero flips that ratio: 90%+ absolute reductions, with removals reserved for a small residual. In practice, if your footprint today is 500,000 tCO₂e, a net-zero pathway means getting down to 25,000 to 50,000 tCO₂e through decarbonization levers, then using permanent removals for what's left. Carbon neutrality allows you to keep higher emissions and bridge the gap with credits.

Role of avoidance vs removal credits. Carbon-neutral claims historically relied on avoidance credits (renewable energy projects, cookstoves, forestry). Net-zero frameworks increasingly require durable removals (biochar, enhanced weathering, direct air capture) for residuals. This matters because research shows that many avoidance credits suffer from over-crediting. A meta-analysis found pervasive baseline inflation and leakage issues, with fewer than 16% of credits delivering robust climate benefit. For net zero, quality and permanence are non-negotiable.

Timeframe and trajectory. Carbon neutrality can be a near-term milestone (2025, 2030) for defined scopes. Net zero is a 2040 to 2050 commitment requiring interim science-based targets and capital allocation for deep transformation. You'll need board-level buy-in, multi-year CAPEX plans, and a phased procurement strategy for removals.

Verification and auditor scrutiny. ISO 14068-1 and PAS 2060 provide verification pathways for carbon-neutral claims, but auditors increasingly question offset-heavy portfolios under CSRD. SBTi-validated net-zero targets carry stronger credibility because they're grounded in 1.5°C-aligned pathways and require regular progress reporting. With CSRD's limited assurance requirements kicking in, auditors will check how much of your progress is real reduction versus compensation.

EU rules: how CSRD and Green Claims change your use of 'carbon neutral'

The regulatory ground is shifting fast. What was acceptable neutrality language three years ago is now a legal liability.

CSRD and ESRS E1: Separate reductions from compensation. Under ESRS E1 application guidance (AR61 to 62), you must disclose the use of carbon credits separately from your own emissions reductions and targets. That includes volumes, type of credit (removal vs reduction), and durability (biogenic vs technological). If you claim progress toward net zero, auditors will verify that it's driven by internal abatement, not purchased offsets. This transparency requirement makes offset-heavy carbon-neutral claims harder to present as climate leadership.

EU Green Claims Directive: No more generic neutrality. The Empowering Consumers Directive (2024/825) bans generic environmental claims unless they're substantiated and independently verified. The draft Green Claims Directive takes it further: you can't make a "carbon neutral" or "climate neutral" claim based solely on offsetting without detailed proof of the projects, third-party verification, and demonstration that the claim is based on the product's full life cycle. Member states must transpose these rules by 2026, and penalties can reach 4% of annual turnover.

German and Swiss case law: Courts demand granular transparency. In June 2024, Germany's Federal Court ruled that "climate neutral" advertising is ambiguous without immediate context explaining whether it means reduction or compensation. Companies using the term must clarify their offset measures in the same marketing material. Earlier, regional courts in Frankfurt and Düsseldorf prohibited "carbon neutral" claims that lacked project-level detail. Deutsche Umwelthilfe has sued over 100 companies, compelling them to withdraw unsubstantiated neutrality labels. Switzerland's amended Unfair Competition Act (effective January 2025) now reverses the burden of proof: claim-makers must provide objective, verifiable evidence upfront.

Practical risk checklist for existing claims:

- Can you name every offset project, its methodology, and its third-party verification status?

- Do your credits meet current quality standards (additionality, permanence, no over-crediting)?

- Have you disclosed the share of progress that comes from credits vs internal reductions?

- Is your "carbon neutral" language scoped to a specific product, event, or operation, or is it a blanket corporate claim?

- Can your legal and comms teams defend the claim in front of a regulator or court with the documentation you have today?

If you answered no to any of these, it's time to tighten or rephrase your claims.

A simple decision framework: when to use carbon neutral, when to use net zero (or neither)

Not every company should use both terms, and many should avoid "carbon neutral" altogether. Here's a practical way to decide.

Four questions to choose your claim architecture

1. What's your long-term climate ambition? If you're committed to deep decarbonization and a 1.5°C-aligned pathway, anchor on net zero as your corporate goal. Use SBTi's framework to set near-term (2030) and long-term (2050) targets across Scopes 1 to 3. Carbon-neutral language, if used at all, should be limited to interim scopes (e.g., "carbon-neutral operations by 2030" as a stepping stone) with full disclosure that it's not your end state.

2. Which scopes can you credibly cover? For most DACH companies, Scope 3 is the elephant in the room. If you can't yet measure and influence your full value chain, a carbon-neutral claim scoped to Scopes 1 and 2 might be defensible as an interim step, provided you're transparent about what's excluded and actively working on Scope 3. A net-zero target must eventually cover everything.

3. How mature is your decarbonization program? Early in your journey, focus on building a robust GHG inventory, identifying levers, and setting internal reduction targets. Avoid public neutrality claims until you have high-quality credits and documentation that will survive audit. As you mature, you can layer in an SBTi-validated net-zero commitment and phase out generic carbon-neutral messaging.

4. What are your sector and technology constraints? Hard-to-abate sectors (aviation, cement, chemicals) will have higher residual emissions even in 2040. For these, transparent use of durable removals is acceptable within a net-zero pathway. If you're in a service or tech-heavy sector with lower emissions intensity, your residuals should be minimal, making a full net-zero target more credible without heavy reliance on offsets.

Decision outputs: For most large corporates, the safest path is a long-term SBTi net-zero target as the anchor, with tightly scoped, time-bound carbon-neutral claims (e.g., for an event, a specific facility, or Scopes 1 and 2 only) used sparingly and with full transparency. Alternatively, drop neutrality language and simply communicate "X% reduction by 2030, residual emissions compensated through high-quality removals," which is more defensible under EU rules.

High-quality offsets and verification: making your claims CSRD- and litigation-proof

This is where most companies stumble. Buying the wrong credits or lacking documentation can unravel your entire climate strategy.

Core quality criteria. Every credit must meet five tests: Additionality (the project wouldn't happen without carbon finance), Permanence (carbon stays out of the atmosphere for the claimed duration), No leakage (emissions don't just shift elsewhere), Accurate quantification (no over-crediting from inflated baselines), and No double counting (credits are retired once and not claimed by multiple parties). Academic research shows systemic failure on these dimensions. California's forest offset program was found to over-credit by 29%. REDD+ projects have over-crediting ratios as high as 13:1. Cookstove credits were overestimated by a factor of 10.

Why legacy credits are now high-risk. In 2024, the ICVCM rejected most renewable energy credits, which previously made up 32% of the market. Many forestry projects face rising wildfire risk (projected 55% increase by 2080). German companies that bought these credits are now exposed. Senken's analysis found that 68% of DAX40 companies using carbon credits supported projects with no real climate impact. Don't rely on a registry label alone. Gold Standard or Verra certification is necessary but not sufficient.

Building a compliance-ready portfolio. Use multiple layers of scrutiny: registry verification (Verra, Gold Standard, Puro), independent ratings (BeZero, Sylvera), and a deep integrity assessment like Senken's Sustainability Integrity Index, which evaluates 600+ data points across carbon impact, co-benefits, MRV processes, and compliance. Only procure credits that score in the top tier. Blend removal types: nature-based (afforestation, peatland restoration) for near-term cost efficiency, and technology-based (biochar, enhanced weathering, DAC) for long-term permanence and SBTi alignment.

Verification pathways. For carbon-neutral claims, get third-party verification under ISO 14068-1 or PAS 2060. Both require a management plan, annual reporting, and independent audit of your footprint and offsets. For net-zero targets, submit to SBTi for validation. SBTi checks that your targets are 1.5°C-aligned, cover all scopes, and rely on internal abatement, not offsets. This validation is increasingly seen as the gold standard by investors and auditors.

CSRD-ready documentation. Package your evidence: GHG inventory reports, abatement project business cases, carbon credit purchase agreements, retirement certificates, third-party verification statements, and an explanation of how credits fit within your mitigation hierarchy. Store it centrally and grant your auditor read access. Under CSRD, your sustainability report will undergo limited assurance starting in 2025 (for large listed companies) or 2026. Auditors will sample your disclosures, including climate targets and use of credits. If you can't produce the backup within 48 hours, you'll face a qualified opinion or worse.

Final litmus test. Before making any public claim, ask: Could we defend this in front of Deutsche Umwelthilfe, a German court, and our CSRD auditor with the documentation we have today? If not, don't publish the claim. Strengthen your credits, tighten your language, or wait until your program is truly compliance-ready. The cost of getting it wrong (fines up to 4% of turnover, reputational damage, investor flight) far exceeds the cost of doing it right.

.svg)