Key Takeaways

- Corresponding Adjustments are Paris Agreement accounting rules that prevent double counting when mitigation outcomes cross borders—and they now directly shape how your carbon credits appear in CSRD/ESRS reporting, green claims compliance, and stakeholder scrutiny across DACH markets.

- You only strictly need CA-backed credits for specific compliance uses like CORSIA or government NDC programmes, but they're rapidly becoming the high-integrity default for any offset or 'carbon neutral' style claims in Europe, especially after Germany's 2024 BGH ruling tightened advertising standards.

- A pragmatic portfolio strategy means reserving scarce, premium-priced CA-backed units for high-visibility neutralisation claims while deploying high-quality non-CA 'mitigation contribution' credits for beyond-value-chain contributions—with transparent documentation and claim language that distinguishes between the two.

- ESRS E1 already requires you to disclose what share of your credits carries a corresponding adjustment, so you need a simple internal data model, clear evidence trails (Letters of Authorisation, registry labels, contracts), and governance processes that connect procurement, legal, and communications teams before your next assurance cycle.

When a tonne of CO₂ is reduced in Ghana and claimed by a Swiss airline under CORSIA, who gets to count it toward their climate target—Ghana, Switzerland, or both? That's the double-counting problem corresponding to adjustments that were designed to solve. Under Article 6 of the Paris Agreement, a corresponding adjustment is the accounting mechanism that ensures mitigation outcomes are counted only once: the host country subtracts the transferred tonne from its national inventory, and the acquiring country or entity adds it to theirs.

For DACH sustainability managers, this isn't just intergovernmental bookkeeping—it's becoming a practical question in every carbon credit procurement decision, CSRD disclosure, and product claim review. ESRS E1 now asks you to report the share of credits with corresponding adjustments. German courts have curtailed vague 'climate neutral' advertising. And leading standards like VCMI and ICVCM are tying claim types to whether your credits carry CAs. Yet CA-backed supply remains scarce, prices are rising, and the rulebook is still evolving. This guide cuts through the complexity with a clear decision framework, portfolio blueprint, and 12–24 month roadmap so you can act now—without waiting for a perfect Article 6 world or becoming a Paris Agreement expert yourself.

Corresponding Adjustments in Simple Terms

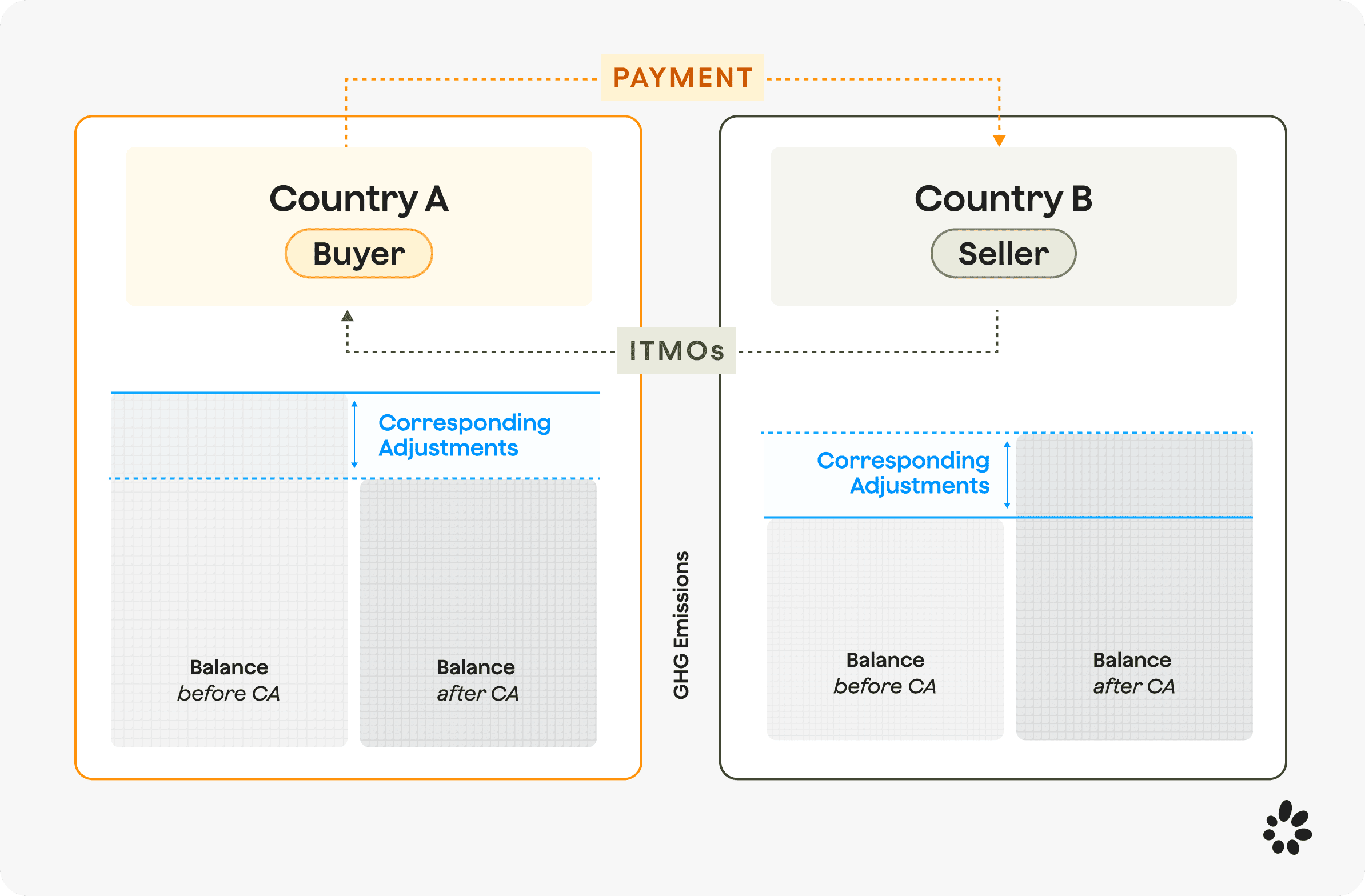

A Corresponding Adjustment (CA) is the accounting mechanism countries use under Article 6 of the Paris Agreement to prevent the same emission reduction from being counted twice. When a mitigation outcome (like a carbon credit) is transferred from a host country to another country or international program, the host country applies a "corresponding adjustment" by adding those tonnes back to its national inventory. The acquiring party then subtracts them when using the credits toward its own climate goals.

Think of it as a receipt system. If Country A generates 1,000 tonnes of emission reductions and transfers them to Country B (or to an airline under CORSIA), Country A must adjust its national accounts so it doesn't claim those reductions toward its own NDC (Nationally Determined Contribution). Country B can then count them. Without this adjustment, both parties would claim the same tonne, undermining the integrity of global climate accounting.

Under Article 6.2, countries bilaterally authorise and transfer "internationally transferred mitigation outcomes" (ITMOs) and must apply corresponding adjustments at first transfer. Article 6.4 creates a UN-supervised mechanism that issues two types of units: "authorised" A6.4ERs (transferable for NDCs or other international purposes, CA-backed) and "mitigation contribution" A6.4ERs (not authorised for international use, no CA required).

For corporate buyers, this distinction matters. CA-backed credits come with the accounting adjustment and are designed for offsetting or neutralising claims that cross borders. Mitigation contribution credits support the host country's NDC directly and are meant for transparency and contribution claims, not for offsetting your own emissions against another country's reductions.

Why Corresponding Adjustments Matter Now for DACH Companies

CAs were originally designed for country-to-country accounting, but they now show up directly in your corporate life in three ways: CSRD reporting, consumer protection law, and stakeholder expectations around greenwashing.

ESRS E1 under CSRD requires you to disclose the share of your carbon credits that carry a corresponding adjustment, while keeping credits separate from your gross emissions. This means auditors will ask: how many of your credits are CA-backed? Do you have documentation? Even though ESRS doesn't mandate CAs for voluntary use, the disclosure requirement signals that CA status is now a corporate-reporting data point.

On the claims side, EU Directive 2024/825 restricts "climate neutral" claims based solely on offsetting unless stringent conditions are met. In Germany, the Federal Court of Justice ruled in June 2024 that advertising products as "climate-neutral" without explaining that neutrality relies on offsets is misleading under competition law. Together, these rules push companies toward more precise language and stronger evidence, and CA-backed credits offer a clearer story: the host country has formally accounted for the transfer, reducing double-claiming risk.

That said, CAs are one integrity dimension among many. They address national-level double counting but don't guarantee that a project has strong additionality, permanence, or safeguards. A CA-backed credit from a low-quality project is still low-quality. Senken's Sustainability Integrity Index evaluates 600+ data points, with CA status as one layer in a comprehensive quality screen. The key is to treat CAs as part of a balanced due diligence approach, not as a magic label.

Do You Actually Need CA-Backed Credits? A Decision Framework by Use Case

The answer depends on what you plan to claim and where you operate.

Compliance, NDC and aviation use cases (CORSIA, government programmes)

Yes, CAs are required. CORSIA requires corresponding adjustments and Letters of Authorization for 2021+ vintages to qualify as eligible emissions units. Similarly, if your company participates in a government program that uses Article 6.2 ITMOs toward a national NDC (like Switzerland's KliK Foundation purchasing credits for Swiss NDC compliance), CAs are mandatory at the first transfer. There's no flexibility here; the rulebook is clear.

Corporate net zero and 'carbon neutral' claims

Increasingly expected, though not yet legally required for all voluntary claims. ICVCM does not mandate CAs for voluntary use but proposes an optional "Paris-alignment" attribute; VCMI does not require CAs for its Carbon Integrity Claims but requires public disclosure of CA status; SBTi encourages beyond-value-chain mitigation and has not made CAs a blanket requirement.

However, the direction of travel is clear. If you're making an offset or neutralisation-style claim (e.g., "our residual Scope 1 emissions are balanced by removals"), using CA-backed credits future-proofs your position. Boards, auditors, and NGOs will ask: if you're claiming to offset emissions, did the host country account for that transfer? A CA-backed credit provides a credible yes.

For high-visibility claims or product-level "carbon neutral" labels in Germany, CA-backed credits reduce legal and reputational risk. For internal net-zero roadmaps where external claims are more muted, you have more flexibility, but expect that scrutiny will tighten by 2027–2028 as CSRD assurance scales up.

Contribution/BVCM claims and internal carbon pricing

CA-backed credits are optional; high-quality non-CA "mitigation contribution" credits are appropriate here. If you frame your purchase as a beyond-value-chain mitigation (BVCM) contribution or climate finance (e.g., "we invested in X tonnes of forest restoration in Country Y to support their NDC"), you're not claiming an offset, so double-claiming risk is lower. In this scenario, mitigation contribution credits without CAs are legitimate, provided you're transparent about what you're funding.

The rule of thumb: match claim type to credit type. Offset/neutralisation language should use CA-backed credits; contribution/investment language can use high-quality non-CA credits. Make the distinction explicit in your sustainability report and internal approvals.

Designing a CA-Aware Carbon Credit Portfolio for 2025–2030

Segmenting your portfolio by claim type and CA status

Build your portfolio in layers, aligned to how you plan to use the credits:

- Layer 1: Compliance and high-risk neutrality claims – Allocate CA-backed credits here. This includes CORSIA obligations, any government-linked programs, and product-level or corporate "carbon neutral" claims in consumer-facing markets (especially Germany). Budget for scarcity and higher cost.

- Layer 2: Beyond-value-chain contributions and mitigation support – Use high-quality mitigation contribution credits (non-CA) from projects that pass rigorous additionality, permanence, and safeguards checks. Frame these as contributions to host-country NDCs, not as offsets. Senken's Sustainability Integrity Index ensures these credits still meet the top ~5% quality bar even without a CA.

- Layer 3: Internal shadow pricing and pilot programs – Where credits are used for internal incentives or learning, CA status is less critical. Focus on quality, co-benefits, and alignment with your sustainability narrative.

This segmentation lets you deploy expensive CA-backed units strategically while continuing to fund high-impact projects where CAs aren't required. It also gives you clear documentation trails for each claim type, which auditors and legal teams will appreciate.

Pricing, scarcity and when to secure CA-backed supply early

IATA's Q4-2024 CORSIA procurement sold 1 million CA-backed jurisdictional REDD+ credits at $21.70/t, sitting above many non-CA voluntary segments that continue to clear in single digits. Multiple analyses suggest CORSIA demand could outstrip supply of CA-eligible units before 2030 without rapid host-country authorization and new project pipelines.

What this means for you: if your 2026–2030 roadmap includes neutrality-style claims, lock in CA-backed supply now through multi-year offtake agreements. Senken's approach is to secure forward contracts with vetted projects that have Letters of Authorization in place or pending, giving you price certainty and guaranteed delivery. Waiting until 2028 when CSRD assurance is in full swing will leave you competing in a seller's market.

For high-quality non-CA credits, supply is broader but still constrained at the top end. Early procurement here also protects you from price volatility and ensures access to projects with strong co-benefits and transparent MRV. The business case for acting now applies across both CA and non-CA segments; the difference is that CA-backed credits face an additional bottleneck (host-country readiness) on top of the usual quality and methodology filters.

Documentation, Reporting and Claims: Making Corresponding Adjustments Audit-Proof

Evidence to collect and how to store it

When you purchase CA-backed credits, insist on three pieces of evidence:

- Host-countryLetter of Authorization (LoA) – A public or contractual document confirming that the host country has authorized the transfer and will apply a corresponding adjustment. UNFCCC CARP's public repository shows LoAs from Switzerland, Ghana, Thailand, Cambodia, Maldives, Tanzania, Honduras, Japan, and others.

- Registry label or serial number notation – Major registries (Verra, Gold Standard) now tag credits with Article 6 authorisation status. Verify that the units you retire carry the "Article 6 authorized" or "CORSIA-eligible" label.

- Host-country CA commitment – Ideally, a statement (in the LoA or project documentation) that the host will make the corresponding adjustment in its next Biennial Transparency Report (BTR) to the UNFCCC.

Store these documents in your internal carbon ledger alongside standard retirement certificates. Set up a simple data model with fields for: credit vintage, project ID, volume, CA status (yes/no), LoA reference, registry label, and claim type. This structure supports CSRD disclosure, internal audits, and any future questions from rating agencies or NGOs.

For non-CA mitigation contribution credits, document that they are explicitly not authorized for international transfer and that your claim language reflects contribution, not offsetting.

ESRS E1 disclosures and greenwashing-safe claim language

ESRS E1 application guidance asks you to disclose "the share (percentage of volume) that qualifies as a corresponding adjustment under Article 6 of the Paris Agreement" and prohibits using credits to reduce reported Scope 1–3 emissions or to meet ESRS targets.

In practice, this means a line in your sustainability report like:

"In 2025, we retired 10,000 carbon credits to support our climate transition plan. These credits were kept separate from our gross emissions reporting. Of the total, 40% (4,000 tonnes) carried a corresponding adjustment under Article 6, sourced from [Project X in Country Y, with LoA dated Z]. The remaining 60% were high-quality mitigation contribution credits supporting host-country NDCs, used for beyond-value-chain mitigation contributions."

For claims, align wording to credit type:

- CA-backed, offset-style: "We purchased and retired [X] Article 6-authorized removal credits from [Host Country], which applied a corresponding adjustment. These credits do not count toward the host country's NDC and were used to address our residual Scope 1 emissions."

- Non-CA, contribution-style: "We invested in [X] mitigation contribution credits in [Host Country] to support its NDC. No corresponding adjustment was applied; we make no claim to offset emissions outside our value chain. This is part of our beyond-value-chain climate finance commitment."

This precision protects you under EU consumer law and German case law while giving auditors the clarity they need for CSRD assurance.

.svg)