The November 2025 draft of SBTi's Net Zero Standard v2.0 marks a significant shift in how carbon credits fit into corporate climate strategy. For the first time, credits are formally integrated into near-term planning rather than treated as a distant consideration for 2050 neutralisation.

This article breaks down the key changes and their implications for companies with SBTi commitments.

From One Dimension to Three

Under the original SBTi framework, the emphasis was straightforward. Companies set near-term reduction targets, aimed to achieve net zero by 2050, and then neutralised residual emissions with removals. Carbon credits were mentioned but never fully integrated into the standard. The prevailing interpretation was to focus on reductions now and think about credits later.

This approach created problems. Most companies postponed decisions on removals and climate finance indefinitely, and very few developed a removals roadmap. Without clear guidance on volume and quality, some organisations bought cheap credits for carbon neutral claims while others avoided the voluntary carbon market entirely.

SBTi v2.0 reframes corporate climate action around three pillars. The first remains emissions reductions in line with 1.5°C pathways. The second introduces responsibility for ongoing emissions through a new mechanism called OER. The third emphasises the use of removals, especially durable ones, to address residual emissions over time.

Reductions remain non-negotiable. The difference is that carbon credits now have a defined and structured role within the framework.

Ongoing Emissions Responsibility Explained

Ongoing Emissions Responsibility, or OER, is the central innovation of v2.0. The concept is simple. While a company reduces emissions in line with its targets, it also decides how to handle the emissions that remain each year. OER provides the mechanism to describe and disclose that decision.

During target validation, companies must state whether they will purchase carbon credits for at least 1% of their ongoing emissions. Two approaches are available.

The first is ton-for-ton. Companies purchase verified, high-integrity carbon credits corresponding to at least the OER share of ongoing Scope 1-3 emissions. A company emitting 1 million tCO₂e per year that chooses 1% OER would buy credits for at least 10,000 tCO₂e.

The second is money-for-ton. Companies introduce an internal carbon price and direct the resulting budget into eligible climate actions. This can include high-integrity credits, advanced market commitments for removals, mitigation-enabling investments, or innovation support.

OER does not replace emissions reductions. It sits on top of reduction pathways as a way to contribute beyond a company's own value chain during the decarbonisation journey.

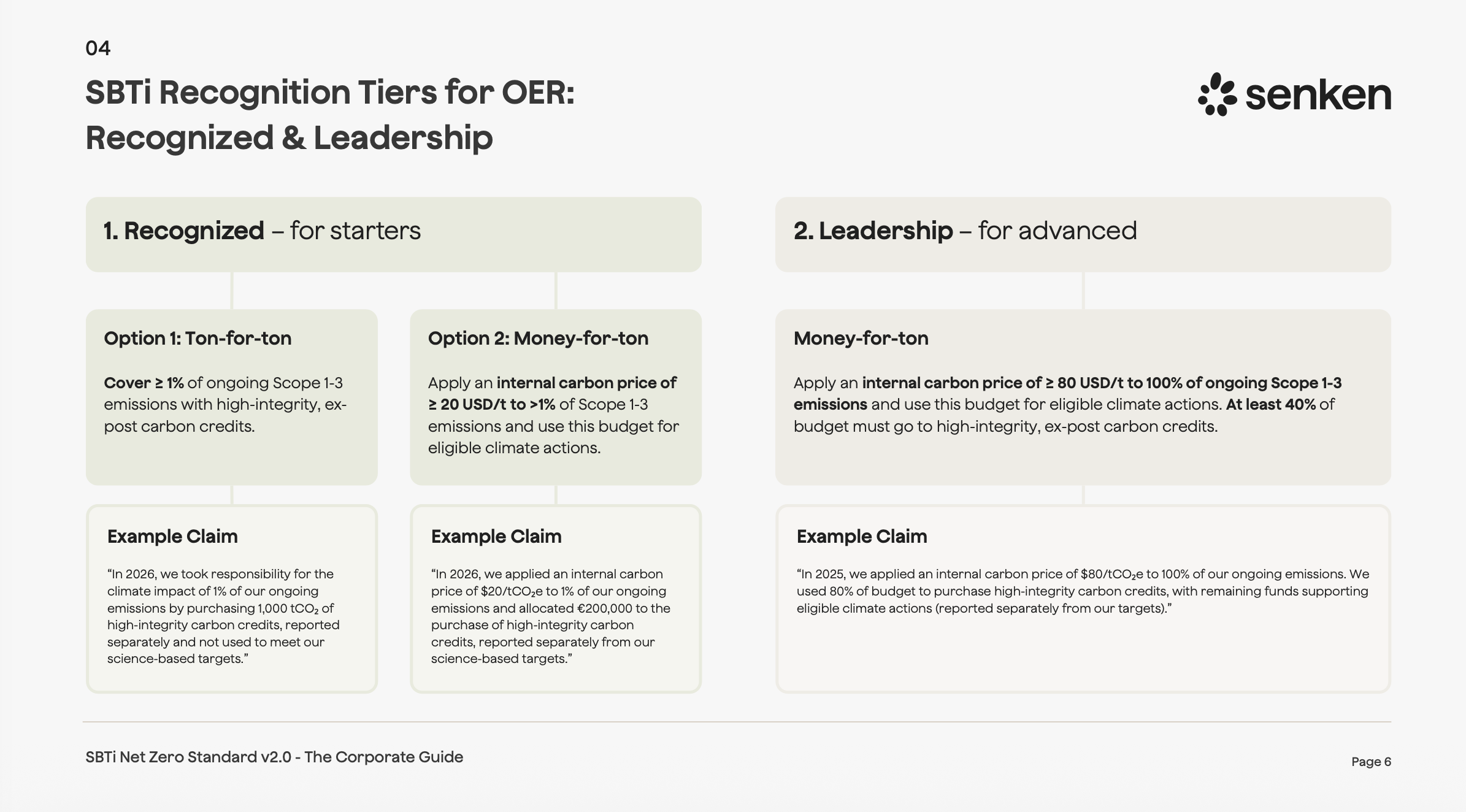

Recognition Tiers: Recognized and Leadership

Companies that take responsibility for ongoing emissions can achieve one of two recognition levels.

The Recognized tier serves as the entry level. Companies can qualify through two options. The first option requires covering at least 1% of ongoing Scope 1-3 emissions with high-integrity, ex-post carbon credits. The second option involves applying an internal carbon price of at least $20 per tonne of CO₂e to at least 1% of Scope 1-3 emissions and directing this budget toward eligible climate actions.

The Leadership tier represents a more advanced commitment. Companies must apply an internal carbon price of at least $80 per tonne of CO₂e to 100% of ongoing Scope 1-3 emissions. At least 40% of the resulting budget must go to high-integrity, ex-post carbon credits.

For reporting purposes, SBTi provides guidance on claim language. A company achieving Recognized status might state: "In 2026, we took responsibility for the climate impact of 1% of our ongoing emissions by purchasing 10,000 tCO₂ of high-integrity carbon credits, reported separately and not used to meet our science-based targets."

Mandatory Removals from 2035

From 2035, large companies will be required to use carbon removals to take responsibility for a rising share of their ongoing emissions.

The requirements focus on what SBTi calls Category A companies. This category includes all large companies with more than 1,000 employees or more than $450 million in turnover. It also includes medium-sized companies in high-income countries with more than 250 employees and either $25 million on the balance sheet or $50 million in turnover.

These companies will need to cover a growing share of ongoing emissions with ex-post removals, scaling toward 100% by 2050. Portfolios must include a mix of short-lived and durable removals, with the durable share increasing over time.

Short-lived removals are often nature-based solutions such as afforestation, regenerative agriculture, and mangrove restoration. These projects provide important co-benefits for biodiversity and local communities. Durable removals store carbon over centuries to millennia. Examples include biochar, direct air capture, and enhanced rock weathering. By 2050, at least 41% of a company's carbon removal portfolio must consist of durable removals.

Exact percentages for 2035 have not been finalised. Based on the draft, the requirement is expected to start around 1% of total emissions and scale progressively to 100% by 2050.

The strategic implication is clear. Waiting until 2035 to engage with the removals market will mean less choice and higher prices. Companies that start early with pilot portfolios gain time to build internal knowledge, test suppliers, and understand the legal, accounting, and reputational dimensions of carbon removal procurement.

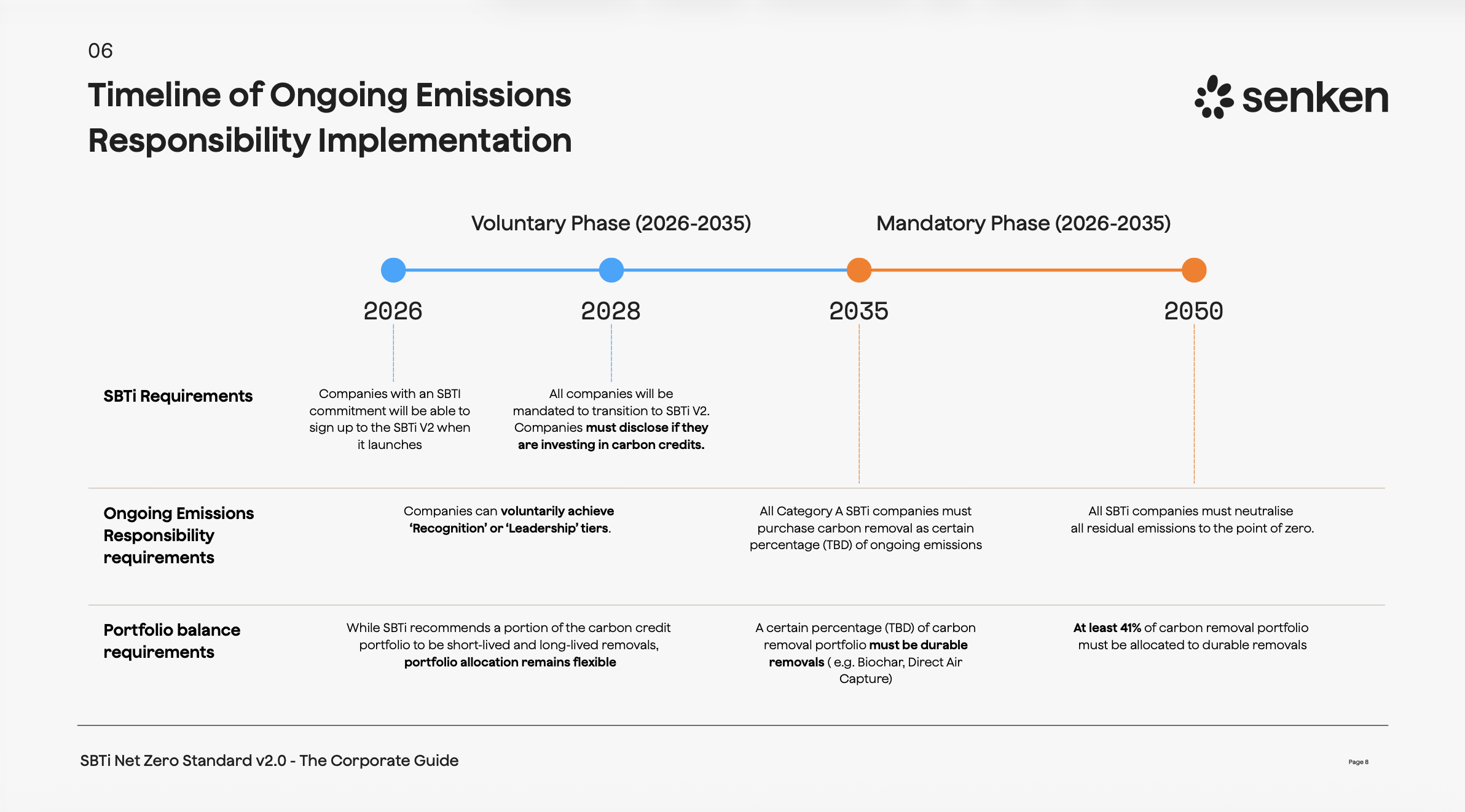

Timeline at a Glance

The implementation unfolds across four key milestones. In 2026, companies with an SBTi commitment can opt into v2.0 and pursue OER recognition tiers on a voluntary basis. By 2028, all SBTi companies must transition to v2.0 and disclose whether they invest in carbon credits. From 2035, carbon removals become mandatory for Category A companies, with durable removals required as part of the portfolio mix. By 2050, all SBTi companies must neutralise 100% of residual emissions, with at least 41% of the removal portfolio allocated to durable solutions.

Carbon Credit Quality Requirements

For OER investments to be validated by SBTi, carbon credits must meet integrity standards. While final guidance remains in development, the draft outlines seven core principles.

Credits must demonstrate accuracy, meaning each credit genuinely represents one tonne of CO₂e reduced or removed based on accepted accounting methods. They must have exclusive issuance, preventing a project from issuing two different instruments for the same climate impact. Performance must be verifiable through transparent, traceable, and auditable evidence. Credits must be traceable from project to buyer, with clear information on technology, location, and timing of impact. They must be issued within systems that have provisions for certificate expiry. All issuance, transfers, and retirement must occur on a secure public registry. Finally, the registry setup must prevent double counting while allowing co-claims where justified.

These principles sound straightforward, and nearly every credit on the market claims to meet them. The challenge lies in the gap between claiming compliance and actually delivering it. Studies show that 86% of registry credits fail deeper quality scrutiny. Registry approval alone is not sufficient for SBTi alignment.

Companies should seek independent quality ratings from providers such as BeZero, Sylvera, or Renoster, with a minimum rating of BB+. They should verify additionality by examining project financial analysis, satellite monitoring data, and credible baseline assessments. Permanence matters as well, requiring attention to buffer pool allocations, insurance mechanisms, and reversal risk assessments. Methodologies with known integrity issues should be avoided — ICVCM has already rejected renewable energy projects, and cookstove credits remain under scrutiny. Finally, companies should demand full traceability with due diligence reports for every project in their portfolio, not just retirement certificates.

Preparing for SBTi v2.0 Alignment

Senken works with large European enterprises to build carbon credit portfolios that meet SBTi and CSRD requirements. The approach combines rigorous project evaluation with end-to-end procurement support.

Every project undergoes assessment through Senken's Sustainability Integrity Index, which analyses more than 600 data points to verify compliance with ICVCM and SBTi requirements. Only the top 5% of available credits pass this screening. Portfolio design follows SBTi's direction on short-lived and durable removals while diversifying across geographies and methodologies to manage risk.

Beyond procurement, Senken provides the documentation that sustainability teams need for audits and stakeholder communication. This includes integrity reports for every project and a Champion's Kit containing materials for SBTi and CSRD audits as well as responses to questions from boards and press.

Companies such as Deutsche Telekom have used this approach to transition from legacy credit portfolios toward future-ready removals strategies aligned with where SBTi v2.0 is heading.

.svg)