Key Takeaways

- Carbon credits are a governance tool for managing residual emissions and beyond-value-chain mitigation – not a shortcut around decarbonisation.

- The carbon market is now a core financial and regulatory topic: 80+ carbon pricing instruments cover ~28% of global emissions and generate over $100 billion in annual revenues.

- The voluntary carbon market is in a "flight to quality": overall volumes have contracted, retirements are stable, and removal credits trade at ~3.8x the price of reductions.

- Audit-ready procurement means more than a registry logo – you need structured quality criteria, layered due diligence, and CSRD-ready documentation that links credits to claims.

- Sustainability leaders in DACH can de-risk greenwashing and price shocks by setting clear guardrails, phasing in durable removals, and using platforms like Senken's SII to pre-screen projects.

Carbon credits are probably the most controversial line item in your sustainability budget – and the hardest to defend to your CFO, legal team, and works council. Yet under tightening CSRD disclosure rules, the EU Green Claims Directive, and evolving SBTi guidance, they're increasingly unavoidable for managing residual emissions you can't eliminate in the near term.

Here's the reality: the carbon market has moved from a CSR nice-to-have to a regulated, multi-billion-euro compliance and risk-management tool. Eighty carbon pricing instruments now cover roughly 28% of global greenhouse gas emissions, generating over $100 billion in government revenues in 2024 alone. At the same time, the voluntary carbon market contracted sharply in 2023 – transaction volumes dropped 56% to $723 million – as buyers paused to reassess quality after high-profile greenwashing scandals. But retirements held steady at around 182 million tonnes in 2024, and removal credits now trade at nearly four times the price of reductions, signalling that serious buyers are still active but far more selective.

This guide won't rehash Carbon 101 theory. Instead, it will show you how to decide when to use carbon credits in your net-zero plan, what to buy (and what to avoid), and how to build an audit-ready procurement process that your finance, legal, and sustainability assurance partners can sign off on. If you're sitting between ambitious climate targets, sceptical stakeholders, and a limited budget, this is your playbook for navigating the market without stepping on a greenwashing landmine.

What Is a Carbon Credit – and Where It Fits in Your Net-Zero Plan

Clear Carbon Credit Definition for Corporate Buyers

A carbon credit represents one metric ton of CO2-equivalent greenhouse gas emissions that have been reduced, avoided, or removed from the atmosphere. Each credit is issued under a recognised standard—such as Verra, Gold Standard, or Puro.earth—and can only be claimed once, when it is formally retired in a registry.

For DACH sustainability leaders, this simple definition hides important complexity. Carbon credits are tradable environmental attributes. They can change hands multiple times on secondary markets before a buyer retires them to support a climate claim. The World Bank's 2025 State and Trends report tracks 80 carbon pricing instruments globally and estimates about 28% of global GHG emissions are now covered by a carbon price, mobilizing over $100 billion for public budgets in 2024. What was once a niche CSR tool is now embedded in mainstream policy and financial markets.

The Decarbonisation Hierarchy: Avoid, Reduce, Then Use Credits

Carbon credits are not a shortcut to net zero. They sit at the bottom of the decarbonisation hierarchy: first avoid emissions through operational changes, then reduce what remains through efficiency and fuel switching, and finally use high-quality credits to address residual emissions that are technically or economically infeasible to eliminate.

This hierarchy is explicit in the Science Based Targets initiative (SBTi) and the Oxford Principles for Net-Zero-Aligned Offsetting. SBTi allows credits only for beyond-value-chain mitigation—funding climate action outside your own footprint—and is exploring limited use for hard-to-abate Scope 3 categories. The Voluntary Carbon Markets Integrity Initiative (VCMI) similarly permits credits under its Scope 3 Action Code, but only after demonstrating ambitious internal reductions.

For your board and auditors, this framing is critical: credits complement decarbonisation; they don't replace it.

Carbon Credits as a Governance Tool, Not a PR Label

Position carbon credits internally as a risk management and governance instrument. They help you:

- Manage residual emissions that won't hit zero by 2030 or 2040

- Price and hedge future compliance exposure as ETS coverage expands

- Demonstrate climate leadership to investors, customers, and employees

- Build supply relationships for durable removals before the market tightens

Yet quality is the constraint. Analysis by Senken and the Max Planck Institute shows that the majority of credits on the market carry high integrity risks—overstated baselines, weak additionality, or poor permanence guarantees. In fact, research indicates that 84% of carbon credits may not deliver the claimed impact. This reality makes rigorous due diligence non-negotiable and sets the stage for the quality frameworks discussed later in this guide.

How Carbon Credits Work in Practice

From Project Idea to Issuance

Every carbon credit begins with a project design document (PDD) that defines the activity, sets a baseline (what would have happened without the project), and selects a methodology approved by a standard. The project developer submits the PDD to a validation body—an accredited third-party auditor—which checks additionality, baseline robustness, and leakage estimates.

Once validated, the project is registered and begins monitoring emissions reductions or removals. At regular intervals (often annually), a verification body reviews monitoring data and issues a verification statement. Only then does the standard's registry mint and issue credits corresponding to verified tonnes.

What you should check at issuance:

- Is the methodology still accepted under ICVCM Core Carbon Principles or CORSIA eligibility lists?

- Are baselines conservative and grounded in recent data, or are they "grandfathered" from outdated assumptions?

- Does the verification report flag any material uncertainties or non-conformances?

Trading and Price Formation Along the Credit Lifecycle

Credits can trade multiple times between issuance and retirement. Prices vary widely—from a few euros per tonne for older avoidance credits to hundreds of euros for engineered removals—driven by project type, vintage, geography, co-benefits, and integrity labels.

LSEG (Refinitiv) estimates that traded global compliance carbon markets reached €881 billion (about $949 billion) in 2023, with around 12.5 billion metric tons of permits changing hands; the EU ETS accounted for ~87% of total value. These figures show that carbon is now a liquid financial instrument with real profit-and-loss impact for covered entities.

For corporate buyers outside direct ETS obligations, voluntary carbon credits trade on smaller but growing platforms, with prices increasingly stratified by quality. In 2024, removal credits were on average 381% more expensive than reduction credits in the voluntary carbon market (VCM), reflecting scarcity and higher costs.

Retirement, Claims, and What Your Auditor Will Ask For

Retirement is the non-negotiable anchor for any climate claim. When you retire a credit in a recognised registry (Verra, Gold Standard, APX, etc.), it is permanently removed from circulation and linked to your organisation's account.

Your auditor—and increasingly, CSRD assurance providers—will ask for:

- Registry retirement certificates with unique serial numbers

- Verification statements from the most recent monitoring period

- Project documentation (PDD, monitoring reports, baseline analysis)

- Transaction records proving you hold legal title at retirement

- Internal rationale linking retired credits to specific residual emissions or beyond-value-chain claims

Without this documentation bundle, you cannot substantiate climate claims under the EU's Empowering Consumers Directive or upcoming Green Claims Directive, both of which impose heavy penalties for unsubstantiated environmental assertions.

Carbon Credits, Offsets, and Allowances: What Your CFO Needs to Know

Carbon Credits vs Carbon Offsets

Use carbon credit to describe the tradable unit (one tCO2e), and carbon offset to describe how you use that unit—to compensate or "offset" your own emissions.

In practice: a corporate buyer purchases carbon credits and retires them to offset residual emissions. The terms are often used interchangeably, but precision matters when communicating with finance and legal teams who need to understand asset ownership, balance-sheet treatment, and claim substantiation.

Allowances vs Offsets in EU ETS, ETS2, and Other Schemes

Allowances (e.g., EUAs, UKAs) are compliance instruments under cap-and-trade systems. If your operations fall under the EU ETS (power, heavy industry, and now maritime from 2024), you must surrender one allowance for each tonne of covered emissions. The EU's separate ETS2 for buildings and road transport starts in 2027 with a 2027 cap of 1,036,288,784 allowances, all auctioned. This expansion will directly affect fuel suppliers and indirectly raise costs across value chains.

Voluntary credits cover emissions outside compliance schemes—typically Scope 3 or voluntary commitments. Some schemes allow limited offset use: California's cap-and-trade permits up to 4–6% compliance via approved offset protocols; CORSIA (aviation) has begun generating material credit demand, with industry projections of ~146–236 million tonnes required in the 2024–2026 phase.

Mapping Instruments to Your Emissions Footprint

Create a simple matrix for internal alignment:

Miscommunicating internally—"we're offsetting EU ETS emissions"—can create confusion and risk non-compliance. Use neutral, accurate language: "We surrender EUAs for Scope 1; we purchase voluntary removal credits to address residual Scope 3."

Types of Carbon Credit Projects – Designing a Resilient Portfolio

Avoidance and Reduction Projects

Avoidance credits prevent emissions that would otherwise occur. Common project types include:

- REDD+ and improved forest management (IFM): Protecting existing forests from deforestation or degradation. These can deliver large volumes and strong co-benefits but face permanence and baseline challenges.

- Renewable energy: Where additionality can be demonstrated (increasingly rare in mature markets), wind, solar, and hydro projects generate credits. However, the Integrity Council for the Voluntary Carbon Market (ICVCM) has rejected most renewable energy methodologies from receiving its Core Carbon Principles label.

- Methane capture: Landfill gas or agricultural methane projects offer strong additionality and measurable impact.

- Cookstoves: Once popular, but recent analysis shows credits were significantly overstated; many buyers now exclude them from procurement strategies.

Why legacy avoidance credits are risky: Methodologies developed a decade ago often used weak baselines. Today's rating agencies and ICVCM assessments flag many of these projects, and reputational risk is high.

Nature-Based Removal Projects

These projects actively remove CO₂ from the atmosphere and store it in biological systems:

- Afforestation, reforestation, and restoration (ARR): Planting trees or restoring degraded land. Storage durability ranges from decades to a century, depending on species and management.

- Blue carbon: Mangrove, seagrass, and tidal marsh restoration. High co-benefits for biodiversity and coastal resilience, but monitoring is complex.

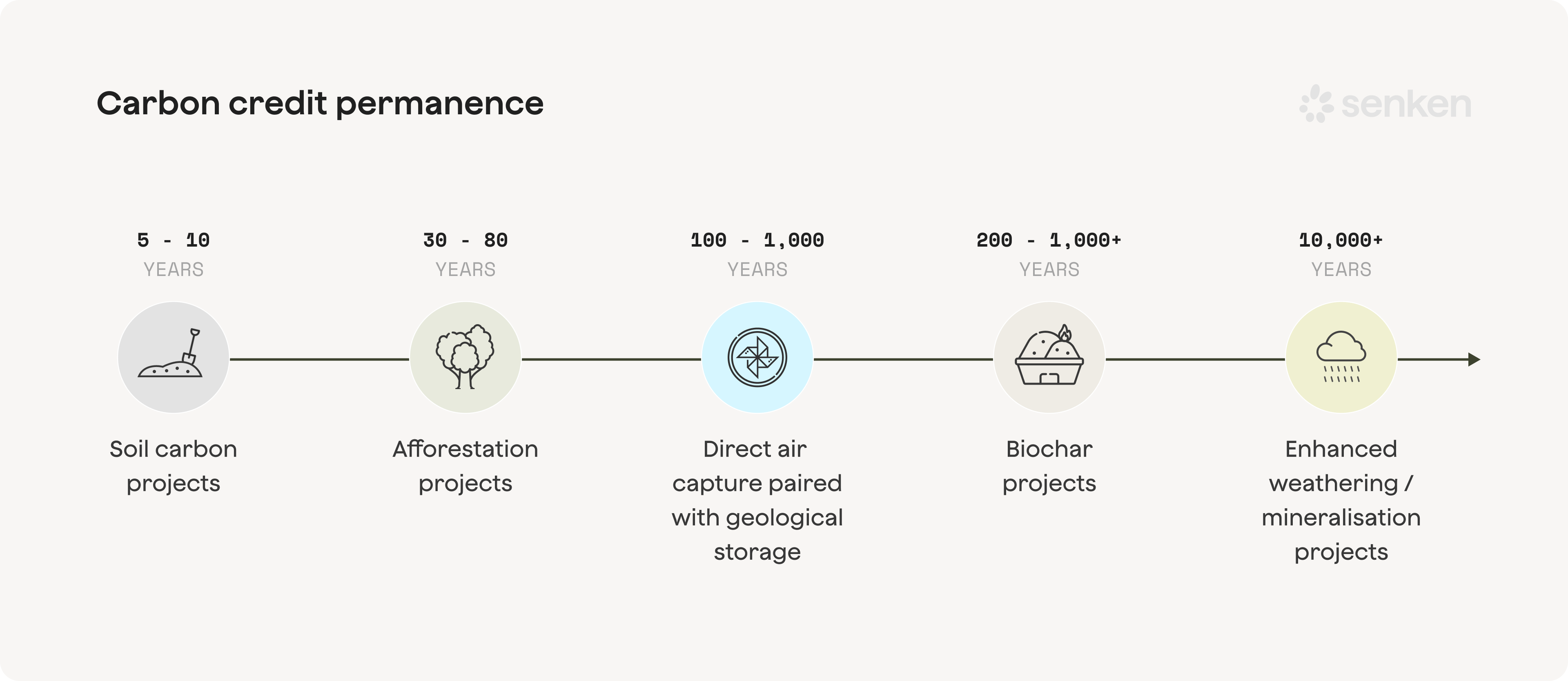

- Soil carbon and regenerative agriculture: Practices that build soil organic matter. Permanence is limited (typically <100 years) and reversibility is a concern if land use changes.

Nature-based removals offer near-term scalability and strong SDG co-benefits, making them suitable for the early phases of a corporate portfolio. However, you'll need a plan to phase in more durable solutions.

Engineered Removal Projects

Engineered removals use technology to capture and store carbon for centuries to millennia:

- Biochar: Pyrolysis of biomass into stable carbon-rich material applied to soils. Permanence >1,000 years; current costs €100–250/tonne.

- Direct air capture (DAC): Machines scrub CO₂ directly from ambient air and store it geologically. Permanence >10,000 years; costs currently €300–600/tonne but falling.

- Enhanced weathering and mineralisation: Spreading crushed silicate rocks to accelerate natural carbon uptake. Early-stage but highly durable.

SBTi's draft Net-Zero Standard 2.0 (March 2025) signals that interim removal targets will likely start at 0.5–2.8% of total emissions by 2030 and increase gradually, with a growing share required from "novel removals" (1,000+ year durability) as companies approach 2050. This makes engineered removals critical for long-term net-zero credibility, even if they are expensive today.

Building a Blended Portfolio

A defensible, Oxford-aligned portfolio balances near-term volume (nature-based removals, high-quality avoidance) with long-term durability (engineered removals). For example:

- 2025–2027: 70% nature-based removals, 20% methane capture, 10% biochar

- 2028–2030: 50% nature-based, 30% biochar, 20% DAC or enhanced weathering

- Post-2030: Majority durable removals (biochar, DAC, mineralisation) as supply scales and costs moderate

This phased approach spreads budget impact, locks in relationships with high-quality developers, and aligns with emerging SBTi guidance.

Carbon Credit Markets Explained: Voluntary, Compliance, and Aviation

Compliance Markets and Carbon Pricing

ICAP's 2025 Status Report lists 38 emissions trading systems (ETSs) in force and ~20 more in development or consideration; China's national ETS is expanding beyond the power sector to steel, cement, and aluminum, adding an estimated 3 GtCO₂e of coverage. For DACH corporates, the most relevant systems are:

- EU ETS: Covers power, industry, and (from 2024) maritime. Allowance prices have ranged €60–100/tonne in recent years.

- EU ETS2: Launching 2027 for buildings and road transport fuels. Expected to raise compliance costs for fuel distributors and downstream users.

- UK ETS and Swiss ETS: Linked or shadow EU pricing; relevant for UK or Swiss subsidiaries.

These systems define a compliance demand baseline. Your finance team should model ETS exposure as a cost line, especially as caps tighten and more sectors are covered.

The Voluntary Carbon Market's Flight to Quality

Ecosystem Marketplace reports 2023 VCM transaction value of $723 million and a 56% drop in transacted volume versus 2022. This contraction reflects buyer caution after critical media coverage of certain project types. However, retirements (a proxy for end-user demand) held "fairly steady" at 182 million tonnes in 2024 , signaling that serious buyers are still active—they're just more selective.

S&P Global tallies 13.16 million CCP-approved credits issued and 3.42 million retired in 2024—still a small but growing subset of the total market. This emerging quality tier commands premium prices and is increasingly favoured by compliance-adjacent buyers (e.g., CORSIA airlines) and corporates seeking audit-ready portfolios.

What this means for you: Expect more competition for high-integrity supply, convergence between voluntary and compliance standards, and the risk that low-quality credits become "stranded assets" as regulations tighten.

CORSIA, Article 6, and "Compliance-Adjacent" Credits

CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) entered its first compliance phase in 2024. ICAO has approved programs including ACR, ART TREES, CAR, Gold Standard, and Verra for supplying CORSIA-eligible units; ICAO encourages Letters of Authorization to avoid double-claiming under the Paris Agreement. Airlines must offset a portion of growth in international emissions, creating predictable, large-scale demand for credits that meet CORSIA's eligibility and corresponding-adjustment requirements.

Article 6 of the Paris Agreement establishes international carbon market mechanisms. COP29 decisions and subsequent 2025 work have advanced the UN-managed Article 6.4 mechanism toward operational roll-out (registry, methodologies, accreditation). As Article 6.4 credits (A6.4ERs) and bilateral ITMOs under Article 6.2 come online, they will set a new compliance-grade benchmark—and likely command premium pricing.

For corporate buyers, the lesson is clear: credits that qualify under CORSIA or Article 6 are de facto higher quality and more future-proof. Build procurement policies that favour these attributes.

Who Verifies Carbon Credits – and Why Logos Aren't Enough

Major Standards and What They're Strong At

- Verra (VCS): The largest standard by issuance volume; strong in forestry and REDD+ but under scrutiny for baseline robustness in some legacy projects.

- Gold Standard: Historically focused on renewable energy and household devices; emphasises sustainable development co-benefits.

- ART TREES: Jurisdictional REDD+ at subnational or national scale; designed to address leakage across large landscapes.

- Puro.earth: Specialises in engineered carbon removal (biochar, enhanced weathering).

- American Carbon Registry (ACR), Climate Action Reserve (CAR): North American focus; CAR is a key supplier to California's compliance offset program.

Each standard has methodologies suited to particular project types, but no single registry label guarantees integrity. Standards set minimum rules; they don't assess every project's real-world performance in detail.

ICVCM Core Carbon Principles, CORSIA, and Article 6

The Integrity Council for the Voluntary Carbon Market (ICVCM) has introduced Core Carbon Principles (CCPs) as a meta-standard. Program-level approvals now cover the vast majority of 2023 retirements, and category-level approvals are expanding. A CCP label signals that a credit meets high thresholds for additionality, permanence, robust quantification, and sustainable development safeguards.

About one-third of legacy credits (mainly renewables and cookstoves) have already been disqualified from CCP eligibility. For DACH buyers, this means:

- Favour CCP-approved programs and methodologies in new procurement.

- Review existing portfolios for exposure to excluded categories.

- Anticipate further tightening as ICVCM completes category assessments and as the EU's Carbon Removal Certification Framework (CRCF) becomes operational.

Independent Ratings and Multi-Criteria Screening

Sophisticated buyers layer in independent ratings from agencies like BeZero, Sylvera, and Renoster, which score individual projects on additionality, permanence, and co-benefits. A project rated below BBB often carries moderate to high integrity concerns.

Platforms such as Senken go further, applying structured, multi-criteria frameworks. Senken's Sustainability Integrity Index (SII) evaluates projects across more than 600 data points, covering carbon impact, beyond-carbon co-benefits, MRV processes, and compliance/reputation risk. Only about 5% of assessed projects pass Senken's thresholds—a strong signal that registry certification alone is insufficient.

Minimum verification stack for DACH corporates:

- Standard certification (Verra, Gold Standard, etc.)

- CCP approval (program and, where available, category level)

- Independent rating (BeZero, Sylvera, or equivalent)

- Platform or internal due diligence using structured quality criteria (e.g., Senken SII)

- Documentation for auditors: PDD, verification reports, retirement certificates, transaction records

Document this verification approach in your internal procurement policy and share it with assurance providers early.

Why DACH Companies Buy Carbon Credits Today

Net-Zero, SBTi, and VCMI Alignment

Most large DACH corporates have committed to net-zero targets aligned with the Paris Agreement. SBTi's Corporate Net-Zero Standard requires near-term (2030) and long-term (2050) emission reduction targets, plus a plan to neutralise residual emissions. While SBTi currently treats credits as "beyond value chain mitigation" (optional), the draft Net-Zero Standard 2.0 signals that removal credits will soon become mandatory to address residuals.

VCMI's Scope 3 Action Code allows companies to use high-quality credits to accelerate Scope 3 reductions, provided they meet strict governance criteria and demonstrate ambitious internal action. Both frameworks create a pathway for defensible credit use—if, and only if, you prioritise quality and transparency.

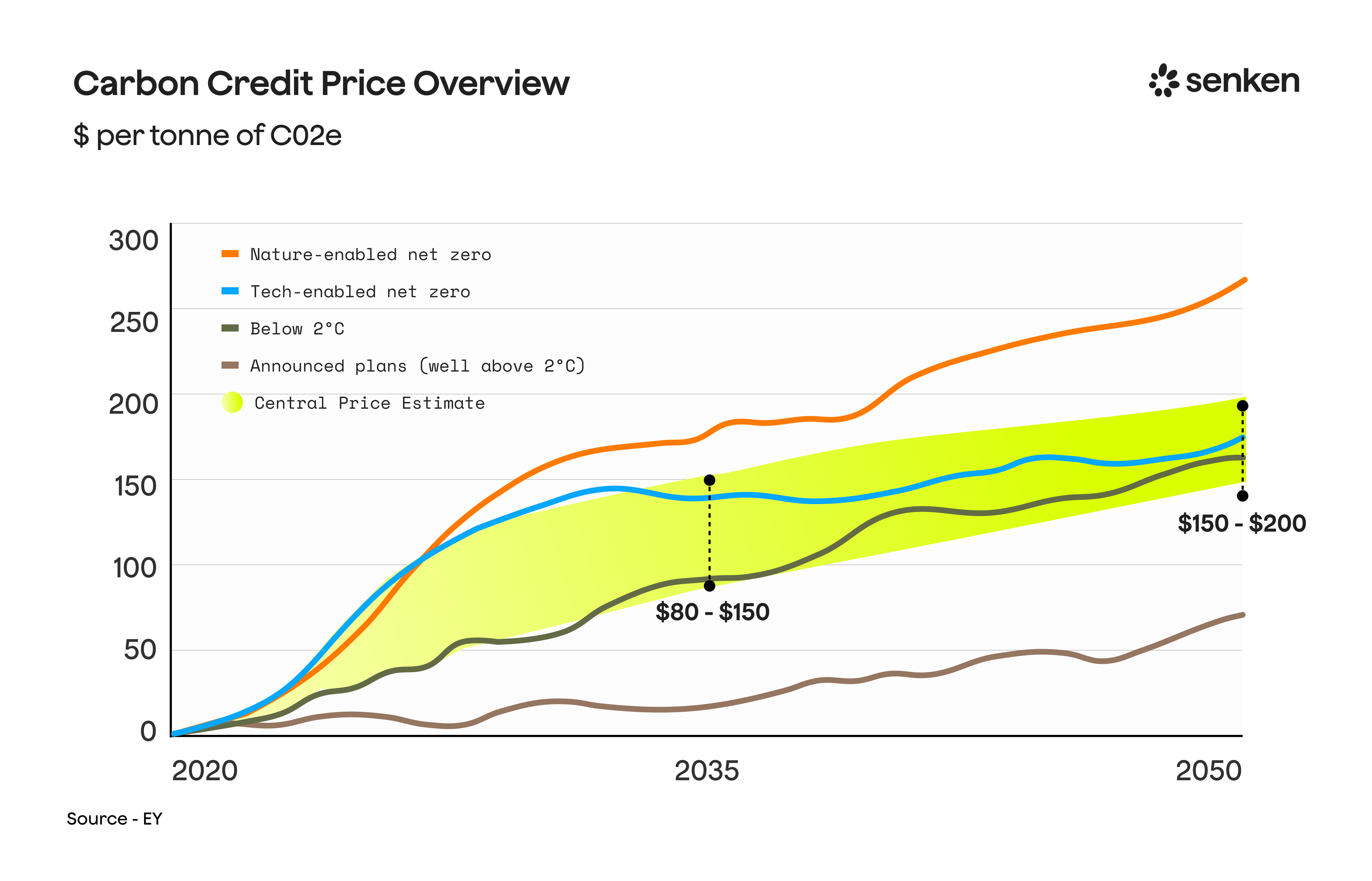

Preparing for Regulation and Price Risk

By 2030, carbon removal demand is expected to exceed supply by at least 1 gigaton, leaving more than 70% of demand unmet. Prices for high-quality durable removals are projected to rise from around €50/tonne today to €146/tonne by 2030. Early procurement locks in lower prices and secures access to constrained supply.

From a compliance perspective, the EU's CSRD requires disclosure of emissions and mitigation strategies, including carbon credits. The Green Claims Directive will mandate third-party verification of environmental claims and impose fines up to 4% of annual turnover for greenwashing. For DACH corporates, voluntary action today reduces forced, expensive action—and regulatory penalties—later.

The Internal Business Case: Finance, Legal, and Brand

Finance: Companies with credible ESG strategies benefit from lower financing costs. Studies show ESG-aligned firms experience a 0.7% reduction in the weighted cost of debt and a 0.4% lower cost of equity. For a company with €2.5 billion in debt, this translates to nearly €9 million in savings over ten years.

Legal: German courts have ruled that the term "climate neutral" is ambiguous and requires explicit clarification about whether it refers to reductions or compensation. The EU's Empowering Consumers Directive bans generic green claims without substantiation. High-quality credits with full documentation reduce legal exposure.

Brand: Surveys show 55% of consumers no longer trust corporate sustainability claims, but 70% are willing to pay a 10–25% premium for credibly sustainable products. Credits alone won't build trust, but defensible, transparent use of high-quality credits as part of a broader strategy can.

How Much Do Carbon Credits Cost – and How to Plan Your Budget

Key Price Drivers Across Project Types

Prices vary by:

- Project type and mechanism: Avoidance vs removal; nature-based vs engineered

- Permanence/durability: <100 years (forestry) vs >1,000 years (biochar, DAC)

- Integrity labels: CCP-approved, CORSIA-eligible, Article 6 authorized

- Geography and co-benefits: Local projects, biodiversity, SDG contributions

- Vintage and transaction size: Recent vintages and forward offtakes command different pricing

Typical Price Bands and Durability Trade-offs

Indicative 2025 price ranges (per tCO₂):

Removal credits priced on average ~381% higher than reduction credits in 2024 , reflecting scarcity, higher costs, and greater regulatory durability. This premium is not speculation—it's the market signaling that removals are scarce and more valuable for long-term compliance.

Designing a Phased Removals Ramp Within Budget

Start with a removals target trajectory aligned with SBTi draft guidance and Oxford Principles:

- 2025–2027: Source 10–20% of your credit needs from nature-based removals (ARR, blue carbon) or lower-cost engineered removals (biochar). Keep the majority in high-quality avoidance (methane) to manage cost.

- 2028–2030: Increase removals to 30–50%, shifting more volume to biochar and beginning small offtake agreements for DAC or enhanced weathering.

- 2031–2040: Majority durable removals (>50%), with increasing share of novel/engineered methods as technology scales and unit costs fall.

Budget internally as a ramp, not a cliff: spreading removals procurement over 5–10 years avoids budget shocks and allows you to benefit from improving cost curves and expanding supply.

Risk of "cheap today, expensive later": Low-quality portfolios purchased at €5/t may need to be written off and repurchased at €100+/t when ICVCM, CORSIA, or CRCF exclude those methodologies. Early investment in quality is rational risk management.

Evaluating Carbon Credit Quality: A Practical Checklist

Additionality and Robust Baselines

Additionality means the project would not have happened without carbon finance. Test this with three lenses:

- Financial additionality: Is the project economically viable without credit revenue?

- Regulatory additionality: Does the project go beyond legal requirements?

- Common practice: Is this activity already standard in the region?

Weak baselines—"what would have happened without the project"—are a major source of overcrediting. Look for:

- Recent, location-specific data rather than national averages or outdated benchmarks

- Conservative assumptions in deforestation-risk modeling or grid emission factors

- Third-party challenge: Has the baseline been scrutinised and upheld in validation?

Projects with "grandfathered" baselines from 10+ years ago should be treated as high-risk.

Permanence, Durability, and Reversal Risk

Permanence describes how long carbon stays out of the atmosphere. For forestry, this is decades to a century; for biochar or mineralisation, it's millennia.

Assess reversal risk by examining:

- Buffer pool contributions: Does the project contribute credits to a pooled insurance fund managed by the registry?

- Monitoring frequency: Annual or more frequent satellite/drone monitoring?

- Political and climate stability: Is the project in a region prone to land-use conflict, illegal logging, or wildfire?

Senken's SII, for example, evaluates reversal and leakage risks using independent earth observation data and adjusts project scores dynamically. Static validations are no longer sufficient in a changing climate.

MRV, Leakage, and Double Counting

Measurement, Reporting, and Verification (MRV) should be:

- Transparent: Raw data and methods published or accessible under NDA

- Frequent: Annual verification at minimum; continuous digital MRV for high-value projects

- Independent: Third-party verifiers accredited by the standard

Leakage occurs when a project shifts emissions elsewhere (e.g., deforestation moves to an adjacent area). Look for conservative leakage discounts (10–30% depending on project type) and evidence of landscape-level analysis.

Double counting is addressed through registry serial numbers and, increasingly, through corresponding adjustments under Article 6. If a host country intends to count the emission reduction toward its own NDC, it must issue a corresponding adjustment to avoid both you and the country claiming the same tonne. For CORSIA and Article 6 transactions, this is becoming mandatory.

Co-Benefits, SDGs, and Social Licence

Projects that deliver benefits beyond carbon—biodiversity restoration, community livelihoods, water security—are more resilient to criticism and regulatory shifts. Senken's SII evaluates 105 "beyond carbon" data points covering social (economics, human rights, welfare), environmental (biodiversity, water, soil), and governance factors.

.png)

Ask:

- Does the project contribute to specific SDGs, with evidence (e.g., jobs created, hectares of habitat restored)?

- Are local communities consulted and compensated?

- Is there a grievance mechanism?

Co-benefits alone don't guarantee carbon integrity, but they strengthen the overall value proposition and stakeholder acceptance.

Deal-Breaker Red Flags for DACH Corporates

Exclude projects that:

- Use legacy renewable energy or cookstove methodologies flagged by ICVCM or independent research

- Have poor external ratings (below BBB) without strong compensating factors

- Lack transparent, accessible documentation (paywalled PDDs, missing monitoring reports)

- Are under active controversy (license revocations, investigative journalism)

- Offer prices far below market for the claimed quality (if it looks too good to be true, it is)

Document these exclusions in your procurement policy and share them with sellers upfront.

Common Concerns and Greenwashing Risks – and How to De-Risk Your Strategy

What We Learned from DAX40 Carbon Credit Portfolios

Senken analysed publicly available data from all 40 DAX companies. Key findings:

- 68% of DAX40 buyers that purchased carbon credits ended up supporting projects with no real climate impact.

- Of the 25 DAX companies that bought credits, only 8 met high-integrity thresholds when assessed under Senken's 600+ data-point framework.

- German companies collectively spent an estimated €70 million on ineffective credits over three years.

Common mistakes included purchasing renewable energy credits later rejected by ICVCM, investing in cookstove projects that Berkeley research found were overcredited by a factor of 10, and relying on controversial REDD+ projects facing governance challenges.

Regulators, Courts, and the New Green Claims Landscape

Germany: The Federal Court of Justice ruled in June 2024 that the term "climate neutral" is ambiguous and requires immediate clarification in advertising. Companies must specify whether neutrality is achieved through emission reductions or offsets.

EU directives:

- Empowering Consumers Directive (ECD): Adopted in 2024. Bans generic green claims (e.g., "climate neutral") unless substantiated with lifecycle evidence.

- Green Claims Directive (GCD): In draft. Will require third-party verification of explicit environmental claims and impose fines of at least 4% of annual turnover for violations.

High-profile cases illustrate the stakes: Delta Air Lines faced a class-action lawsuit over "carbon neutral" claims; Deutsche Umwelthilfe (DUH) has sued German firms including Beiersdorf and Faber-Castell; FIFA was ruled guilty of greenwashing by the Swiss Fairness Commission for the 2022 World Cup.

Conservative Guardrails for Credit Use and Claims

To de-risk your strategy:

- Use credits only for residual emissions after demonstrable internal reductions.

- Separate reductions and compensation explicitly in all communications: "We reduced Scope 1 & 2 by X%; we address residual Y tonnes with high-quality removal credits."

- Adopt exclusion lists: No legacy renewables, no cookstoves, no projects rated below BBB without deep due diligence.

- Require independent ratings and CCP labels for all new purchases.

- Document everything: PDD, verification reports, retirement certificates, internal rationale, and compliance mapping.

This governance approach—clear rules, layered verification, full transparency—turns a potential greenwashing liability into an audit-ready, defensible position.

How to Source High-Quality Carbon Credits: A Step-by-Step Playbook

Set Governance Rules and the Role of Credits in Your Net-Zero Pathway

Before you approach the market, define:

- Which emissions can be addressed with credits (residual Scope 1 after abatement? hard-to-abate Scope 3 categories?)

- Who approves credit purchases (sustainability lead, CFO, legal, board sustainability committee?)

- Acceptable project types (removals only? nature-based plus engineered? geographic preferences?)

- Minimum quality thresholds (CCP-approved, independent rating ≥BBB, vintage <5 years?)

- Removals trajectory (e.g., 20% removals by 2028, 50% by 2035, 80% by 2040)

Document these rules in an internal carbon credit procurement policy and socialise it with procurement, legal, and finance.

Shortlist and Due Diligence: From Universe to Final Portfolio

With thousands of projects on the market and the majority carrying high risks, manual screening is not scalable. Use a structured process:

- Pre-filter for recognised standards (Verra, Gold Standard, ACR, Puro) + CCP program approval + minimum rating (if available).

- Use a platform that pre-screens across hundreds of data points—for example, Senken's SII evaluates 600+ criteria and accepts only ~5% of projects.

- Apply the 10 key questions to any seller:

- Do you publish full project documentation without paywalls?

- What percentage of your portfolio is CCP-approved or pending?

- What proportion achieves >200-year carbon storage?

- How frequently do you reassess reversal risks with satellite data?

- Have you ever listed projects rated below BBB—if so, which and why?

- What portion of your portfolio would meet EU CRCF thresholds?

- How is your selection team insulated from commercial pressure?

- How many projects do you list? (Hundreds = likely low quality)

- Can you provide third-party additionality and baseline documentation?

- If a project loses certification or is reversed, will you replace or refund?

- Conduct enhanced due diligence on finalists: review PDDs, verification statements, external ratings, and media/NGO coverage.

Contracting, Retirement, and CSRD-Ready Documentation

Negotiate contracts that specify:

- Volume and delivery schedule (spot purchase, forward contract, multi-year offtake?)

- Price pathway (fixed, indexed, tiered by vintage?)

- Delivery guarantees and remedies (replacement credits if verification is delayed or project underperforms)

- Documentation obligations: seller must provide PDD, monitoring reports, verification statements, and registry retirement certificates within defined timelines.

Once credits are retired in your name, assemble a documentation bundle for each vintage:

- Registry retirement certificate (serial numbers, retirement date)

- Project design document

- Most recent verification report

- Baseline and additionality analysis

- MRV summary (monitoring methodology, frequency, results)

- Transaction record (proof of purchase and legal title)

- Internal memo linking retired credits to specific emissions or claims in your CSRD sustainability statement

This bundle is your audit-ready evidence pack. Platforms like Senken automate much of this assembly, ensuring CSRD compliance and streamlining assurance processes.

.svg)