TL;DR

- The Oxford Offsetting Principles are now the de facto benchmark for credible carbon offsetting—referenced by regulators, investors, and NGOs—and the 2024 revision makes clear that most current offsetting practices are not yet aligned with net zero.

- For corporates, Oxford alignment means three concrete actions: prioritise value chain emissions cuts, define what counts as truly residual emissions, and build a time-bound transition plan toward carbon removals with durable storage by 2030–2050.

- A simple portfolio diagnostic can reveal where your current credits fall short on integrity, removals share, and storage durability—giving you a clear roadmap for clean-up and smarter procurement before CSRD audits and EU Green Claims enforcement intensify.

- Embedding Oxford criteria into procurement RFPs, internal governance, and CSRD reporting is the most effective way to manage greenwashing risk and demonstrate credible climate action in a tightening regulatory landscape.

The Oxford Offsetting Principles started as an academic framework in 2020. By 2024, they've become the standard that regulators, investors, and NGOs use to judge whether your carbon offsetting strategy is credible—or greenwashing. The revised 2024 version is blunt: it describes current carbon markets as needing a "major course-correction" and makes clear that the vast majority of today's offsetting approaches are not getting companies any closer to net zero.

For sustainability leaders in corporates, this matters right now. You're facing CSRD reporting deadlines, stricter EU Green Claims rules that ban vague "climate neutral" slogans, and internal pressure to keep using carbon credits but with far stronger proof of impact. The Oxford Principles offer a science-based roadmap—but only if you can translate them into audit-ready procurement criteria, governance processes, and portfolio decisions.

This guide shows you how to turn the Oxford Principles into a practical, Oxford-aligned carbon credit strategy within the next 12–24 months—covering portfolio diagnostics, procurement levers, regulatory alignment, and the governance structures you need to defend your approach under scrutiny.

What Are the Oxford Offsetting Principles (2024)?

The Oxford Offsetting Principles are a science-based framework developed by the University of Oxford to guide net zero aligned carbon offsetting. Since their original publication in 2020, hundreds of organisations have used them as a reference point for credible climate strategies. The 2024 revision provides critical clarifications based on the latest climate science and calls for a major course-correction in how carbon markets operate.

The four principles are straightforward:

Principle 1: Cut emissions first and ensure credit integrity. Prioritise emissions reductions within your own value chain, use only high-quality credits with verified environmental integrity, and regularly update your strategy as best practice evolves.

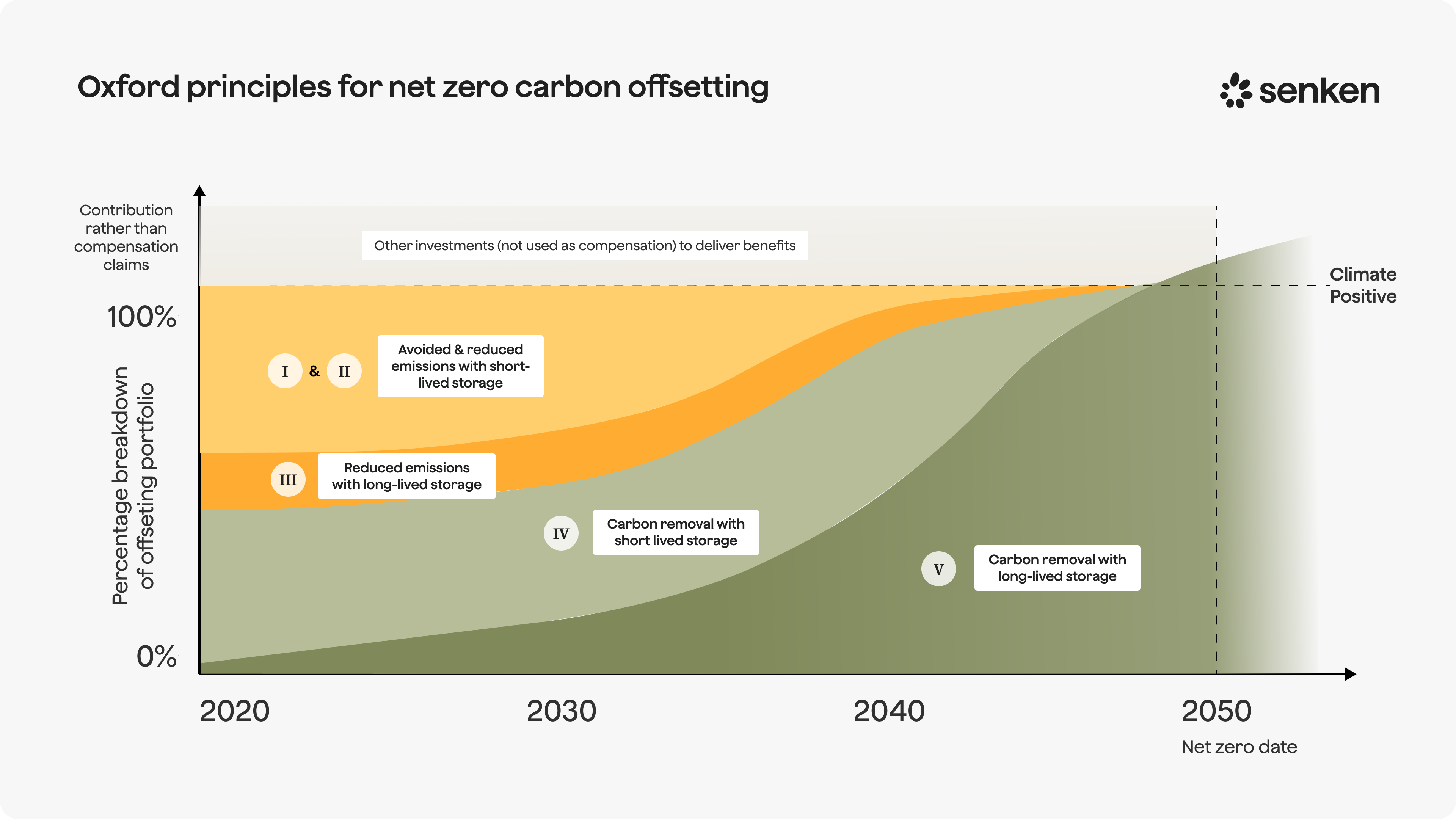

Principle 2: Transition to carbon removal offsetting. By the global net zero target date, any residual emissions you cannot eliminate should be balanced with carbon removals, not avoidance or reduction credits.

Principle 3: Shift to durable storage. As you approach net zero, the removals you use must demonstrate low risk of reversal. Short-lived storage cannot fully neutralise fossil CO₂ emissions over the relevant climate timeframes.

Principle 4: Support innovation. Back the development of new removal technologies and integrated approaches that help scale high-quality climate solutions.

The 2024 update emphasises urgency. It acknowledges that most current offsetting practices do not yet deliver net zero alignment and highlights the critical need to scale carbon removal rapidly while recognising both the potential and limits of nature-based solutions. Crucially, the revision clarifies that durability matters: scientific evidence shows CO₂ storage of less than 1,000 years is insufficient to neutralise fossil emissions, meaning companies must increasingly prioritise geological storage, mineralisation, and other long-duration removal pathways.

What the Oxford Principles Mean for Corporate Net Zero Strategies

For large companies navigating CSRD timelines and EU Green Claims enforcement, the Oxford Principles provide clarity on three strategic questions: when to use offsets, what type of credits to buy, and how to defend your choices under audit.

Residual emissions are the target. Oxford's framework reinforces what SBTi and IPCC guidance already state: carbon credits cannot substitute for deep decarbonisation. You cut emissions across Scopes 1, 2, and 3 first. Only after exhausting feasible reduction measures within your value chain should you use high-integrity credits to address residual emissions. This hierarchy directly supports CSRD's ESRS E1 requirement to disclose gross emissions separately from any offsetting, and it aligns with national guidance like Germany's Umweltbundesamt criteria that prioritise avoidance and reduction before compensation.

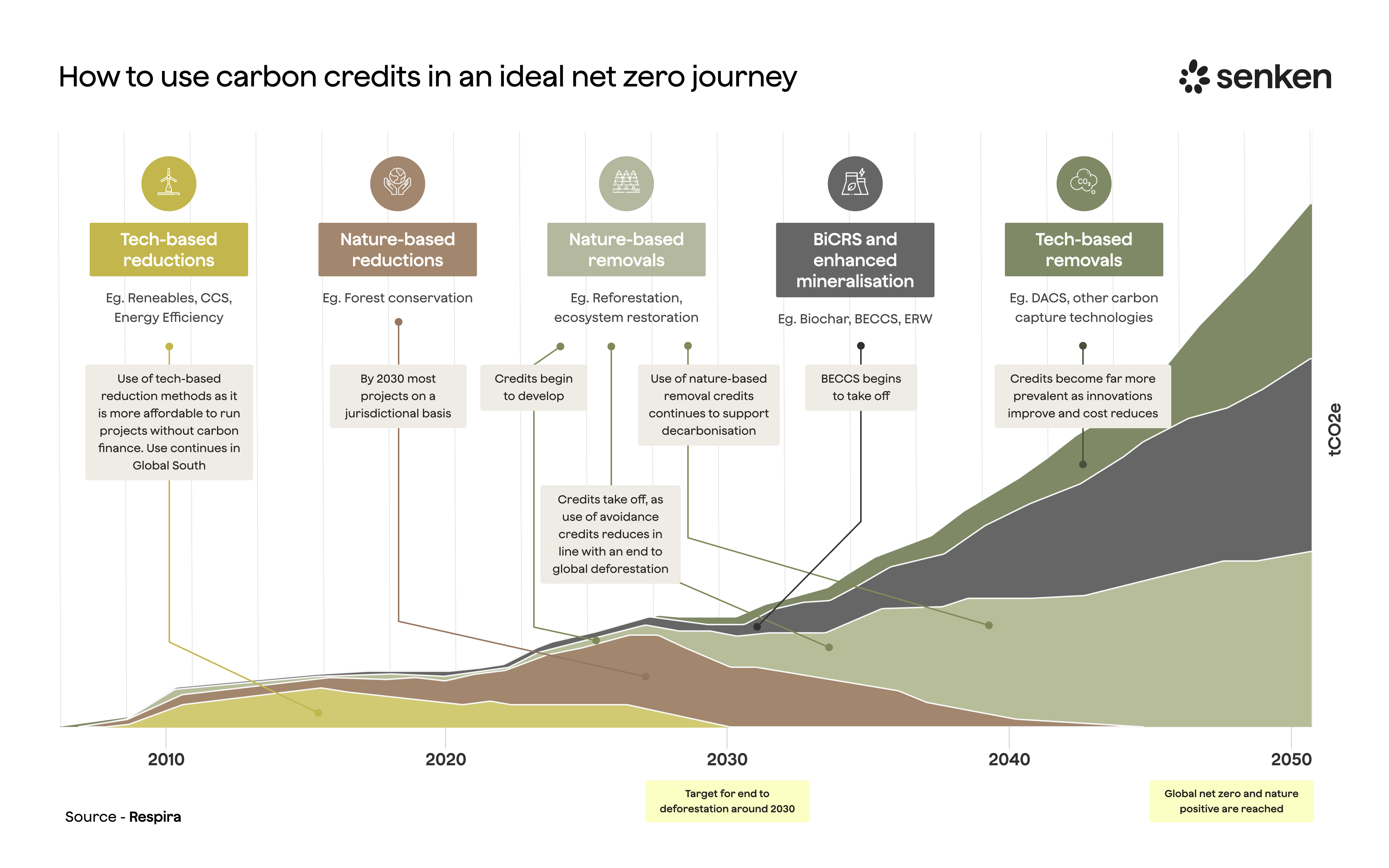

Removals become mandatory, not optional. The second and third principles establish a clear timeline: by your net zero target date, the credits you retire for residual emissions must be removals, and progressively those removals must feature durable storage. This is not aspirational language. Global carbon removal must scale from roughly 2 GtCO₂ per year today to 7–9 GtCO₂ per year to meet climate goals, and corporates are expected to drive that demand. Market data already reflects this shift: in 2024, removal credits commanded a 381% price premium over reduction credits, up from 245% in 2023, and durable removal contracting nearly doubled in Q2 2025 alone.

Internal alignment is essential. Oxford alignment is not just a procurement issue. It shapes conversations with your CFO (budget for higher-cost removals), legal team (greenwashing risk mitigation), communications (defensible claims), and board (strategic credibility). By anchoring your offsetting strategy in a widely recognised, science-based framework, you reduce the risk that your approach is challenged by regulators, investors, NGOs, or auditors.

Critically, Oxford Principles support but do not replace your existing commitments. They sit alongside SBTi net zero targets, internal carbon pricing, and sectoral decarbonisation roadmaps, providing the integrity backbone for the small share of emissions you cannot eliminate.

Assess Your Current Carbon Credit Portfolio Against the Oxford Principles

Most sustainability teams inherited offset portfolios that were assembled before integrity standards tightened. A simple diagnostic can reveal misalignment early and inform clean-up priorities.

Start with a share-of-spend analysis. Break down your current holdings by reduction versus removal credits. If removals represent less than 10–20% of your portfolio and your net zero date is within 15–20 years, you are not yet on an Oxford-aligned trajectory. Next, classify removal credits by storage duration: short-lived (nature-based solutions with reversal risk, typically decades to a century) versus durable (biochar, enhanced weathering, direct air capture with geological storage, typically centuries to millennia). If you have few or no durable removal credits and your interim targets include 2030 or 2035, that is a flag for action.

Apply an integrity filter.Germany's Umweltbundesamt sets minimum criteria: credits must demonstrate additionality, third-party verification, and be no older than five years at purchase. Layer on ICVCM's Core Carbon Principles (CCP) alignment. Roughly one-third of legacy renewable energy and cookstove credits have already been disqualified by ICVCM. If your portfolio is heavy in these methodologies, you are carrying stranded-asset risk. Independent research shows that 68% of DAX40 companies ended up with low-impact projects, and 84% of credits in circulation are considered high-risk. Run each tranche of your holdings through a structured checklist: Does the project meet current additionality tests? Is permanence monitored with third-party digital MRV? Are safeguards for biodiversity and community rights documented?

Create a traffic-light scorecard. Tag each credit holding as green (Oxford-aligned: high-integrity removal with durable storage), amber (transitioning: high-integrity reduction or short-lived removal), or red (misaligned: weak additionality, outdated methodology, or unverifiable claims). This visual summary is powerful in internal steering committees and helps you sequence portfolio clean-up. Prioritise retiring or replacing red credits, limit new purchases of amber credits, and increase the share of green credits in every procurement cycle.

This self-assessment does not require a 10-person team. Platforms that apply detailed integrity indices across hundreds of data points (additionality, permanence, leakage, co-benefits, compliance) can accelerate the diagnostic and deliver audit-ready evidence packs for each credit.

Design an Oxford-Aligned Portfolio and Procurement Strategy

Translating the Oxford Principles into procurement decisions requires a clear transition pathway, realistic cost planning, and updated RFP criteria.

Map an illustrative glide path. A typical trajectory for a large corporate might look like this: 2025–2027 (near term): majority high-quality avoidance or reduction credits that meet ICVCM standards, with 10–20% pilot allocation to removals (e.g., biochar, regenerative agriculture). 2028–2035 (medium term): 40–60% of new purchases are removals; shift procurement toward projects with clear permanence monitoring and co-benefits. 2036–2045 (long term): 70%+ removals, with increasing emphasis on durable storage (mineralisation, geological sequestration). 2046–2050 (net zero): near-exclusive use of durable removals to counterbalance any residual emissions. This is an example, not a prescription. Your timeline depends on your net zero target date, the feasibility of value-chain reductions, and budget constraints. The key is to set explicit milestones and review progress annually.

Build cost and supply confidence. Removal credits are more expensive because they reflect real durability and rigorous MRV. Rather than treat this as a barrier, frame it as price integrity: you pay for what you get. Manage budget impacts by phasing volume (start with pilot tonnes, scale as internal reductions progress) and by locking in multi-year offtake agreements that secure predictable pricing and priority access to high-quality supply. The biochar market alone grew from €14.6 million in 2022 to €181.5 million in 2024, demonstrating that durable removal supply is scaling and competitive pricing is emerging.

Update procurement criteria. Revise RFPs and supplier contracts to require disclosure of: additionality methodology and evidence, baseline robustness and any challenges, storage duration and reversal risk mitigation plan, third-party verification and digital MRV, safeguards for biodiversity and community rights, and alignment with ICVCM CCP or equivalent. Score projects along a durability spectrum and prioritise those that deliver co-benefits (water, soil, biodiversity) without compromising permanence. Use Senken's Sustainability Integrity Index or similar tools to operationalise these checks across every tonne without building internal scientific capacity from scratch.

Embed Oxford Principles into Governance, CSRD Reporting and Greenwashing Risk Management

An Oxford-aligned strategy is only as strong as the governance and documentation that support it. This is where you turn principles into audit-ready processes.

Define roles and approval flows. Establish who signs off on offset purchases and claims: typically a cross-functional team including sustainability, finance, risk, legal, and communications. Mandate that every procurement over a threshold (e.g., 1,000 tonnes or €50,000) includes a documented integrity assessment covering additionality, permanence, safeguards, and Oxford alignment. Require that any external claim ("carbon neutral," "climate positive," "offsetting X tonnes") is pre-approved by legal and backed by evidence packs that specify gross emissions, residual emissions, credit type (reduction vs. removal), storage duration, and methodology. Review your offsetting strategy at least annually against evolving guidance from Oxford, ICVCM, VCMI, and Article 6.

Map to CSRD and EU Green Claims rules. ESRS E1 requires you to disclose Scope 1, 2, and 3 emissions following GHG Protocol, applying principles of double materiality and quality of information. Offsetting does not reduce your gross emissions figure. You must separately report the type, quantity, and permanence of credits used, and clarify whether you are making a contribution or offset claim. The EU's Empowering Consumers Directive and draft Green Claims Directive go further: generic claims like "climate neutral" based solely on offsets are banned unless you disclose the share, type, and permanence of credits, prove a credible net zero target, and demonstrate that offsets are used only for residual emissions after maximal reductions. An Oxford-aligned approach, where removals with durable storage are reserved for genuine residual emissions, directly supports compliance with these rules and reduces the risk of enforcement action or greenwashing allegations.

Integrate with SBTi, ICVCM, VCMI, and Article 6. The Oxford Principles are part of a broader ecosystem. SBTi allows removals for residual emissions at the net zero target date, consistent with Oxford's second principle. ICVCM's Core Carbon Principles define credit-level integrity, which Oxford's first principle requires. VCMI's Claims Code specifies that only "contribution" claims are appropriate before net zero (not "neutral" or "net zero" claims), and that high-quality credits meeting robust standards should be used. If you engage with Article 6 mechanisms (ITMOs or PACM credits), apply the Oxford Principles for Responsible Engagement with Article 6: ensure use aligns with the Paris Agreement, that credits have climate integrity and safeguards, and that accounting is transparent. A simple internal mapping table (rows: Oxford Principles; columns: SBTi, ICVCM, VCMI, Article 6) helps your team design one coherent policy instead of juggling parallel, conflicting rules.

.svg)